coronavirus

Patrimonium holds €100m first close for debut fund

GP aims for final close within 12 months, despite the ongoing impact of Covid-19

Inflexion donates £2.5m to support Coronavirus relief

GP launched its foundation in 2018 and donates 1% of its profits from funds to the organisation

Insight Partners XI closes on $9.5bn

Fund deploys equity tickets in the $10-350m range in startups operating across the software industry

YFM closes Buyout Fund II on £80m

GP plans to make investments this year and expects prices to drop "somewhat" in the current environment

Advent International announces $25m Covid-19 relief fund

Senior members of the private equity firm personally contributed to the fund

The Deals Pipeline

A fortnightly highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Welcome aboard: PE recruitment amid coronavirus

PE-focused recruiters and some GPs themselves are figuring out ways to progress recruitment processes, but challenges remain

Main Capital buys majority stake in health software firm Alfa

Netherlands-based GP paid тЌ15-20m for its stake in the company

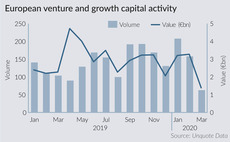

VC, growth activity collapses in March amid Covid-19 outbreak

European VC and growth capital dealflow was no more sheltered than its buyout counterpart

Unquote Private Equity Podcast: Covid-19 special

The team gathers for its first remote podcast, discussing how the early stages of the outbreak have disrupted the European PE landscape

Tech, business services power through amid Covid-19 rout

Of the 53 deals seen in March, 28 came from technology and business services

Debut managers to face daunting fundraising market in 2020

Debut managers out to market are unlikely to hold closes in 2020, and very few new teams are likely to launch funds

Several funds seeking to close in H1 face delays, says Cebile

LPs' reluctance to commit is likely to lead to a number of delays come Q2

Gilde Healthcare V close on $450m hard-cap

Legal advice was provided by a team from Jones Day led by partner Quirine Eenhorst

Turnaround funds eye European companies hit by Covid-19

Turnaround players have raised at least $5bn overall in Europe in recent years

PE examines portfolio liquidity options as coronavirus halts dealflow

Managing financial and liquidity risk is front of mind as managers fret over the potential impact of a severe downturn

UK Covid-19 liquidity support snubs leveraged and mid-market companies

CCFF initiative seems designed with traditional corporate issuers in mind instead of leveraged finance issuers

Secondaries: opportunistic buyers ready for fund stakes to hit market

With more sellers coming to market, prices are unlikely to stay at pre-Covid-19 heights, which could in turn encourage more opportunistic buyers

Main Capital launches restructuring fund for Covid-19 crisis

Fund is dedicated to UTP exposures and is composed of a credit section and a finance unit

Revo Capital Fund II holds first close on €40m

Domiciled in the Netherlands and structured as a BV, the fund has a 2% management fee

German VCs call for more Covid-19 startup support

Concerns centre around the profitability criteria, as well as local banks' lack of familiarity with startups' risk profile

Generalitat Valenciana to launch €200m coronavirus fund

A private equity firm will be selected by the Institut Valencià de Finançes to manage the new vehicle

Nordic buyout market has silver linings, despite low volume

Nordic region sees the lowest quarterly deal volume since Q4 2013, with just 17 buyouts in Q1 2020

UK holiday parks advised to close: Portfolios affected

British Holiday and Home Parks Association has advised its members to close all holiday parks