Dunedin

Dunedin fund surpasses target to reach £300m final close

Dunedin has closed its latest vehicle on ТЃ300m, comfortably surpassing its ТЃ250m target.

Trustmarque completes £19.5m refinancing

Technology services firm Trustmarque, backed by Dunedin, has completed a refinancing to the tune of ТЃ19.5m provided by HSBC Leveraged Finance.

UK tech investments: opportunities and pitfalls

The UK's tech space might be once again a target of choice for private equity, but speakers at a Taylor Wessing seminar recently warned investors to tread carefully to make the best of the good times ahead. Greg Gille reports

Dunedin backs £43m Trustmarque secondary buyout

Mid-market GP Dunedin has backed the ТЃ43m management buyout of Trustmarque Solutions, a technology services and solutions provider, from LDC.

Dunedin's Derry to chair ICAEW corporate finance faculty

The ICAEW Corporate Finance Faculty has appointed Giles Derry, a partner at Dunedin, as its chairman т marking the first time a private equity professional has held the role.

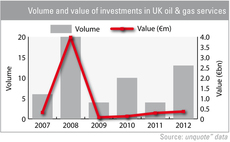

Private equity to benefit from oil & gas boom

The high price of oil could provide a boom to many operating in the oil & gas sector in the UK, and private equity players are looking to take advantage of the opportunities it offers.

Dunedin's CitySprint buys Sameday UK

CitySprint, a distribution network backed by Dunedin, has acquired Sameday UK.

Dunedin's Hawksford acquires Key Trust

Dunedin has acquired wealth management business Key Trust Company Ltd through its portfolio company Hawksford.

Fundraising booms in January

The beginning of 2013 has seen a swathe of fundraising announcements, with several funds reaching their target. Could this trend be a sign that investor appetite for private equity is returning?

Dunedin hits £240m for first close

Dunedin has held a stealth first close on ТЃ240m for its third buyout fund, indicating its target is comfortably within reach.

Dunedin's CitySprint buys Eagle Express

CitySprint, a distribution network backed by Dunedin, has acquired Eagle Express Worldwide Couriers.

Dunedin backs £34.5m MBO of Premier Hytemp

Dunedin has supported the MBO of Scottish oil and gas exploration equipment manufacturer Premier Hytemp from Murray International Holdings.

Dunedin reaps 3x money multiple on etc venues exit

Dunedin Capital Partners has exited UK-based conference and training venues business etc venues in an SBO to Growth Capital Partners (GCP), reaping a 3x money multiple on its original investment.

Dunedin's CitySprint acquires Scarlet Couriers

UK-based distribution network CitySprint, backed by Dunedin Capital Partners, has acquired courier firm Scarlet Couriers.

Dunedin sells Capula to Dutch trade buyer Imtech

Dunedin has sold Capula, a provider of IT systems solutions to energy operators, to Dutch Engineering company Imtech.

Dunedin makes five promotions

Dunedin has made five promotions: Nicholas Hoare has been promoted to COO; Jon Ma, Oliver Bevan and Simon Rowan have been made investment directors; and Jamie Moodie has taken on the role of senior associate.

Euro breakup should be orderly - Dunedin CEO

The ongoing eurozone crisis is a concern on the mind of many PE players, potentially threatening access to financing and the growth prospects of portfolio companies. But, in what could prove to be a controversial view, Dunedin CEO Ross Marshall foresees...

Dunedin refocuses trust for direct investments

Dunedin Enterprise Investment Trust has voted to change its focus to direct buyout investments, rather than third party funds.

Hamilton Lane expands London team

Jim Strang has joined Hamilton Laneтs London investment team as principal.

Dunedin-owned Practice Plan acquires two firms

Dunedin-backed Practice Plan has acquired dental plan provider Isoplan and dental patient finance provider Medenta.

Dunedin's Hawksford acquires Swiss law firm

Wealth-structuring company Hawksford, a portfolio company of Dunedin, has acquired Swiss specialist law firm L-S&S GmbH for an undisclosed amount.

Dunedin acquires CitySprint

Dunedin Capital Partners has acquired courier business CitySprint for an undisclosed amount.

Managing value: back to basics

2009 and 2010 have been all about getting back to basics hands-on operational support. A big part of this is about having the best management for the job. Francinia Protti-Alvarez reports.