Exclusive

MVI closes MVI Fund II above target

MVI Advisors has held a final close for its second fund on SEK 1.1bn

Argos Wityu acquires majority stake in Groupe Fedd

GP bought its 90% stake in the electronics specialist via Argos Wityu Mid-Market VIII

VC firm BGV kicks off fundraise for second growth fund

Upcoming fund will invest 80% of its target size in BGV's existing portfolio companies

Emeram forms EUR 100m continuation fund for Boards & More

Coller Capital has led the deal, joined by existing LPs from Emeram's 2013-vintage debut fund

Saga closes fund-of-funds on EUR 720m hard-cap

Saga was founded by three former employees of Danske Bank's private equity department

Most LPs seek to improve co-investment appeal – Coller Capital

Coller Capital's winter 2021-22 Global Private Equity Barometer covers topics including secondaries

Hg invests in Bowmark-backed Pirum

Hg and Bowmark share joint control of Pirum with the company's management team retaining a significant stake

Nordic Capital registers latest flagship fund

Nordic Capital XI's registration follows the final close of its predecessor in 2020 on EUR 6.1bn

Q3 Barometer: PE scales new heights

The latest Unquote Private Equity Barometer, produced in association with abrdn, is now available to download

Eir closes life sciences venture fund on EUR 122m

Nordic-based Eir Venture Partners has held a final close on EUR 122m for Eir Ventures I

PE firms study rivals' IPOs as they consider options

Recent slew of peer listings such as Bridgepoint and Petershill inspire key players as they mull options for their own businesses

MTIP holds USD 250m final close for second fund

Health technology firm has made five deals from the fund and expects to back 10 companies in total

Unquote Private Equity Podcast: To 12x and beyond

The Clearwater International Multiples Heatmap reveals that average entry multiples broke new records in Q3, on the back of a still-buoyant M&A market

IK Partners ventures into UK mid-cap deal-making

New team will be staffed by three or four investment specialists based in London

Average fund size reaches new heights amid stark market bifurcation

Average buyout fund close for 2021 stands at EUR 1.33bn, more than double the EUR 629m recorded in 2017

Speedinvest launches EUR 80m Climate & Industry Opportunity fund

Fund is intended to back the VC's existing industrial and climate technology startups

Supernova Capital aiming to raise EUR 250m by end of 2022

VC is also considering launching a new fund, Supernova 3, by Q1 2023

Tenzing raises GBP 100m Belay Fund

Vehicle can invest up to GBP 150m and will back the GP's Tenzing II portfolio companies

Capiton holds EUR 504m final close for sixth fund

Capiton VI is now 36% deployed across seven deals and expects to make up to 15 platform investments

Multiples Heatmap: TMT deals inked in Q3 pass 19x mark

Average entry multiples were again pushed into record territory in Q3 on the back of a still-buoyant M&A market

TA Associates buys Ambienta's Nactarome

TA beat contender Apax, which came second in the auction for the Ambienta-backed company

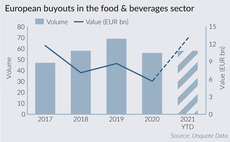

Food and beverage buyouts to reach EUR 13bn in 2021

An average of 44 buyouts totaling EUR 5.1bn were completed in the sector from 2011-2020

UVC holds final close for third fund

UVC Partners has a deployment capacity of EUR 255m with its flagship fund and new Opportunity Fund

Bain gears up for sixth European buyout fund

US-headquartered GP held a final close for its previous European fund in 2018 on EUR 4.35bn