Average fund size reaches new heights amid stark market bifurcation

While the aggregate commitments secured by European private equity managers so far in 2021 are already nearing the previous record set last year, the number of vehicles that reached a final close is on track to be the lowest in years, according to Unquote Data. Greg Gille reports

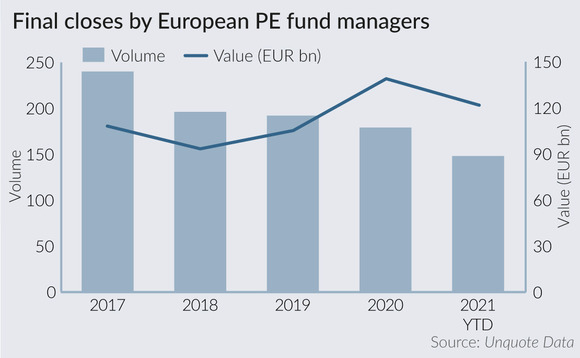

With just a month left in the year, it is increasingly unlikely that 2021 will exceed the record EUR 138.9bn raised by European PE managers in 2020. But the collective performance of the asset class when it comes to fundraising this year remains very impressive, and further adds to the considerable firepower available for deployment in the coming months: Unquote recorded final closes totalling EUR 121.7bn between January and November, significantly exceeding recent year-end totals bar 2020.

The volume of capital targeting European PE opportunities is even more impressive when adding on non-European funds with a remit to invest on the continent: according to Unquote Data, that extended tally has already reached more than EUR 227bn this year. This EUR 100bn differential is largely attributable to a handful of mega-raises by US players with an international remit, such as Hellman & Friedman (USD 24.4bn) and Silver Lake (USD 20bn).

This last point highlights another key takeaway of the fundraising market in 2021, continuing a trend that was already evident last year: while aggregate commitments remain close to record highs, this is being achieved across a dwindling number of fund closes.

Largest European PE fundraises (YTD 2021)

| Name of fund | Fund manager | Fund type | Amount raised (EUR bn) |

| EQT IX | EQT Partners | Buyout |

15.6 |

| Partners Group Direct Equity 2019 | Partners Group | Buyout |

15.0 |

| Apax X | Apax Partners | Buyout |

9.6 |

| Ardian Buyout Fund VII | Ardian | Buyout |

7.5 |

| Coller International Partners VIII | Coller Capital | Secondaries |

7.4 |

| GA 2021 | General Atlantic | Generalist |

6.7 |

| Crown Global Secondaries V | LGT Capital Partners | Secondaries |

4.0 |

| GHO Capital III | GHO Capital | Buyout |

2.0 |

| HIG Middle Market I | HIG Capital | Buyout |

2.0 |

| Main Capital VII | Main Capital Partners | Buyout |

2.0 |

Source: Unquote Data

Unquote Data shows that the EUR 121.7bn raised by European managers this year is spread across 148 vehicles. This is by far the lowest number of final closes seen in recent years – by comparison, 240 final closes were recorded in 2017. In fact, the number of fund closes has steadily declined year-on-year for four years in a row, while aggregate commitments have risen significantly.

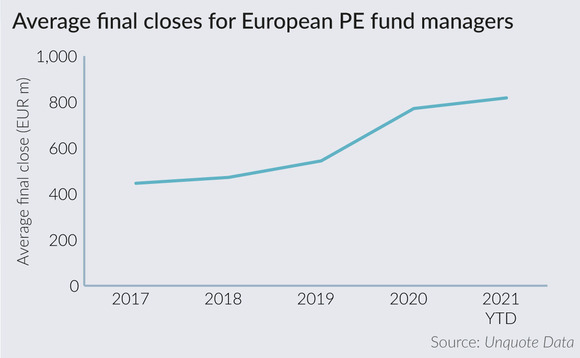

It is therefore unsurprising that the average PE fund has never been so large. The average final close stands at EUR 822m so far this year, nearly double the EUR 450m recorded just four years ago. This is even starker when looking purely at buyout funds: the average close amount for 2021 is EUR 1.33bn, a sizeable jump from 2020's EUR 960m and more than double the EUR 629m recorded in 2017. The venture space has seen a more modest, but still noticeable, fund-size creep: the average European venture fund closed on EUR 151m in 2021, up from EUR 120m in 2017.

This reflects a couple of parallel trends. On the one hand, the average fund size for most managers has indeed increased from one vintage to the next in recent years (sometimes sparking concerns of strategy drift from some LPs). On the other hand, it is very likely that the continued bifurcation in the market, as evidenced by the diverging trends for the number of final closes and aggregate commitments pulled in, is responsible for a significant portion of that average size increase.

Through a combination of the top players raising ever larger funds, while also expanding their strategies to the point of being in a state of near-permanent fundraising, never has as much capital been in the hands of so few managers. More than half (57%) of commitments in 2021 to date has been raised by just 10 managers across as many funds. Looking specifically at buyout funds, the group of GPs attracting more than half of all commitments narrows down to just four managers: EQT, Partners Group, Apax and Ardian.

This is unlikely to change anytime soon, if fundraising pipelines are anything to go by. Unquote has recorded 72 fund launches by European managers so far in 2021, continuing the year-on-year decline witnessed since 2019's 178 launches.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds