Exclusive

Balderton raises USD 600m for eighth flagship fund

Fund will continue the VC's Series A-focused strategy, targeting European startups

Sofinnova holds EUR 150m close for third biotech fund

Impact fund has made two investments as of its interim close and expects to make 10-12 in total

Waterland sells Cawood for 3.7x money

Trade sale to EBI is the first exit from the GP's GBP 2bn, 2017-vintage fund Waterland VI

GP Profile: Adelis steps up deal-making after latest fund close

Co-managing partner Jan У kesson and head of IR AdalbjУЖrn Stefansson speak to Unquote about the Nordic mid-market-focused GP's fundraise and deployment plans

Monterro 4 holds EUR 700m final close

GP will now be making new platform deals from the fund, continuing to focus on Nordic B2B software

DWS holds USD 550m final close for first PES fund

GP's first institutional fund will partner with lower- and mid-market GPs for mid-life secondaries

Announced PE deals fall sharply in October

Could the market have finally reached full capacity following a record-breaking first half of 2021 for M&A?

Unquote Private Equity Podcast: Leisure sector cleared for take-off

Unquote looks back at how the sector has fared, and speaks with PAI partner GaУЋlle d'Engremont following the ECG deal

Victus to come back to market in early 2022

Vehicle will pursue the same strategy as its predecessor, targeting mature agriculture- and food-related businesses

HealthCap looks to future growth after new appointments

Venture capital firm HealthCap is looking ahead to a busy healthcare and life sciences market

Ufenau registers third continuation vehicle

Switzerland-headquartered Ufenau Capital Partners invests in services-focused SMEs

Consumer dealflow rebounds strongly in Q3

More on-trend verticals such as technology and healthcare took a backseat in the third quarter, Unquote Data shows

LP Profile: ACP opens up PE programme

Co-head of PE Michael Lindauer speaks to Unquote about the LP's allocation strategy and its approach in an increasingly competitive market

Startup Wise Guys raising up to EUR 52.5m across three funds

Estonian VC is raising Cyber Fund I, its second Challenger Fund and its Opportunity Fund II

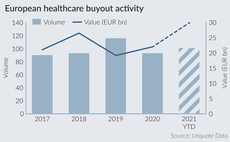

Healthcare buyouts approach record EUR 30bn in 2021

France has been the source of more than half of the aggregate value recorded to date

ECSO on lookout for LPs for EUR 1bn cybersecurity platform

ECSO aims to raise EUR 1bn by the third quarter of 2022, with the platform structured as a fund-of-funds

Carlyle gears up for next Europe Technology Partners fund

GP registers several Carlyle Europe Technology Partners V vehicles, with the most recent fund having closed in 2018

Tenzing sets sights on Nordic countries

Unquote catches up with managing partner Guy Gillon following the appointment of Magnus GottУЅs to lead Tenzing's Nordic expansion

CapMan Wealth Services forms Investment Partners Fund

EUR 90m fund will invest in cooperation with AlpInvest, backing US mid-market funds chosen by the GP

Podcast: In conversation with... Sunaina Sinha, Raymond James | Cebile

The Cebile Capital founder discusses the tie-up with Raymond James, and the key trends at play in the global fundraising and secondaries landscapes

Practica Capital plans new fund launch in 2022

Third-generation fund could be 1.5x to 2x larger than its predecessor

Dunedin team moves on as firm winds down

Mid-cap GP has seen 18 team members depart this year, including three partners, following the decision to halt the fundraise for its fourth vehicle

White Star holds USD 360m final close for Fund III

Growth technology VC held a final close for its predecessor vehicle in 2018 on USD 180m

Mirova contemplates first growth fund as follow-up to ESG vehicle

Firm is eyeing the launch of a growth fund once its recently launched ESG vehicle reaches 75% deployment