Exclusive

Fundraising Report 2021: mapping out the post-Covid landscape

Unquote analyses key trends and presents proprietary data on the European fundraising market

British Patient Capital launches £600m life sciences programme

Programme will invest in later-stage life sciences funds targeting at least ТЃ250m

Spotlight on Spacs: Green power

With an expanded investor universe flush with cash, green may well prove to be gold for Europe's blank-cheque future

Appian weighs fund launch for late 2021

Mining-focused Appian raised $375m for its first fund and $775m for the second vehicle

ACP raises €814m for flagship fund-of-funds

Access Capital Partners held a first close for ACF VIII in June 2019, securing €412m in commitments

GP Profile: Summa Equity

Reynir Indahl believes GPs should move beyond ticking ESG boxes to 'impact-weighted' reporting

Livingbridge buys World of Books from Bridges

Bridges partially exits the company five years after paying ТЃ13m for just over 50% of the company.

True holds £275m final close for third fund

Consumer-focused GP raised the fund in a six-month virtual process and surpassed its ТЃ250m target

European PE buyout activity sets new record in H1

Hectic first quarter drove an unprecedented spike in deal activity, while aggregate value is just shy of hitting an all-time high

Astorg gears up for fund VIII launch

Predecessor Astorg VII held a final close in January 2019 on €4bn

Unigestion holds €611m final close for second Direct fund

Fund surpasses its тЌ600m target and is more than 40% deployed

Karmijn Kapitaal holds first close for third fund

Netherlands-headquartered GP held a final close for Fund II in June 2016 on €90m

Fortino Capital eyes new fund launch for late 2021

Firm will look to mandate a placement agent prior to launching the growth fund

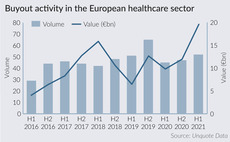

Healthcare buyout value hits new high in first half

Trio of mega-buyouts push the aggregate value of deals to тЌ19.5bn in H1, versus тЌ11bn in H2 last year

Phoenix confirms Sygnature sale to Five Arrows

Deal is the third strong exit from Phoenix's 2016 fund, following Travel Chapter for 3.6x and Rayner for 4.3x

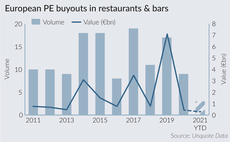

Pandemic sinks dealflow in restaurants & bars to 10-year low

Activity in the sector has not yet returned to previous levels, with four buyouts totalling тЌ285m recorded to date in 2021

Multiples continue to climb in Nordic region as activity booms

Nordic PE market saw record levels of deal value in Q1, with valuations soaring even higher on the back of renewed optimism

Artá Capital becomes independent, eyes €400m for Fund III

Management team buys out Corporación Financiera Alba's stake in the Spanish GP

GP Profile: Palatine looks to B2B, continued ESG value creation

Managing partner Gary Tipper discusses the firm's deal pipeline, its focus on ESG, and how its portfolio has weathered the pandemic

High-Tech Gründerfonds to launch fourth seed fund

Fund expects to launch its official fundraising process in September 2021, subject to BaFin approval

PAI buys Pasubio from CVC

CVC bought Pasubio in 2017 through its CVC Capital Partners VI fund

Healthcare valuations heat up as high-profile assets crystallise competition

Healthcare sector saw multiple valuations pick up in Q1 2021 and hit a record high of 13.7x

ABN Amro launches €425m Sustainable Impact Fund

Fund will make PE and VC investments in the Netherlands and neighbouring countries

Unquote Private Equity Podcast: Fundraising full steam ahead

With record amounts of capital raised in 2020 and a roaring start to 2021, it seems not even a pandemic could slow the momentum of PE fundraising