European PE buyout activity sets new record in H1

A hectic first quarter drove an unprecedented spike in deal activity in the first half of 2021, while aggregate value is just shy of hitting an all-time high, according to Unquote Data.

"We have never been this busy!" has been the common refrain among deal-makers with whom Unquote has spoken over the past couple of months. And this sentiment is borne out in preliminary figures for H1 2021.

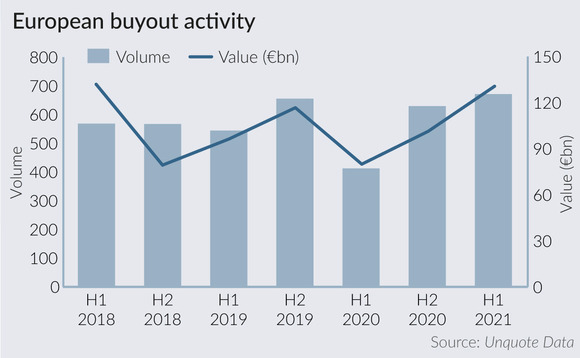

The first half of 2021 further confirmed the sharp activity rebound seen in H2 last year, with buyout dealfow setting a new volume record. Unquote recorded 671 buyouts in the first half of the year, eclipsing the previous record of 655 deals inked in the second half of 2019. By comparison, H1 2020 saw only 412 buyouts taking place.

On the aggregate value side, the buyouts announced in H1 were valued at an estimated €130.7bn in aggregate, very close to the record of €131.9bn seen in H1 2018. It is not inconceivable that this gap could be closed by the time the first-half figures are fully processed by the Unquote research team.

While buyout activity was clearly turbocharged in H1 this year, the preliminary figures indicate that second-quarter activity has lagged behind both Q1 2021 and Q4 2020. Unquote recorded 309 buyouts worth a combined €58bn in Q2 2021, compared with 362 deals for a total of €72bn in the first quarter.

More deals will inevitably come to light in the coming weeks, boosting the quarter's volume total in particular. But it is also likely that process backlogs from 2020 have started to clear up, and PE players are feeling less pressure to stock up on quality assets after a dry spell in Q2-Q3 last year.

The drop from Q1 to Q2 also further highlights how the rush to complete deals in the UK before a potential capital gains tax rate hike drove dealflow in that market, above and beyond the effect of a straightforward post-Covid recovery. The UK was home to nearly 30% of all European buyouts in Q1, while a sharper decline compared to other markets in Q2 brought this proportion back to a much more normal 20%.

More statistical analysis of H1 2021 activity will be available on Unquote in the coming weeks, including the release of the full Q2 2021 Private Equity Barometer.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds