Exclusive

Italian GP Arcadia to start marketing new fund by end of 2021

Arcadia's third fund will be larger than its predecessor, which closed on €80m in 2019

Quantifying PE's appetite for recurring revenue models

Buyouts in sectors where recurring revenue models are predominant went from 8% of European volume in 2010 to 22% in 2021 to date

AM Ventures holds first close for 3D printing venture fund

Additive manufacturing-focused venture capital firm has a target of €100m for the vehicle

Sharp focus on top assets boosts average multiple in consumer sector

Covid-resilient assets are the only ones coming to market, with suitably hefty price tags, says Clearwater's O'Donnell

Beyond Capital Partners sells Sysob to trade

GP invested in the IT equipment distributor in 2016 via BCP Fund I; it is on the road for Fund II

Iron Wolf Capital eyes €30m-plus fund launch after 2023

Baltic venture capital investor raised €21m for its first fund in 2019

Pinova invests in Raynet

GP is investing in the IT service via Pinova II and plans to make two more deals from the fund

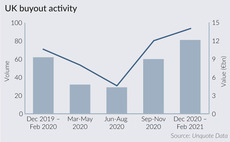

How UK PE buyouts soared ahead of 2021 Budget

Amount of dealflow in the past three months is significantly higher than in previous December-February periods

Miura sells Equipe Cerámicas to Mandarin's Italcer

Miura reinvests in the deal alongside Mandarin and retains a minority stake in the combined group

Nordic players await distressed carve-out uptick

Carve-out activity in the Nordic region hit a three-year low last year, but was still propped up mainly by corporates divesting healthy assets

Saga holds first close on €600m for eighth fund

GP started raising its latest fund in late September 2020 and plans to continue fundraising into Q2 of 2021

Pinova sells Human Solutions, Avalution to Bridgepoint's Humanetics

Deal is a partial exit for Pinova; the GP will retain fashion design software platform Assist

FII to launch €700m Agritech & Food Fund

Fund invests in companies across the food and agriculture sectors to boost their growth and technological development

Sofinnova Crossover Fund closes on €445m

Fund focuses on investments in later-stage biopharma and medtech companies that need capital to scale up

Bowmark, LDC sell Node4 to Providence

IT business was expected to fetch a valuation in excess of ТЃ300m, based on a 15x multiple

Biotech market provides dose of optimism

In the past year, the biotech market has seen buoyant activity, reaching record levels of investments

Synova sells Tonic Games to Epic, nets 200% IRR

Exit closely follows that of Fairstone Group to TA, which resulted in a 4.5x return

Tikehau to become majority shareholder in Cruiseline

Following the deal, Montefiore retains a minority stake and a seat on the company's board

Beyond Black holds first close for Pledge Fund I

Following the тЌ20m first close, the Berlin-based VC aims to launch a larger cleantech-focused fund

NorthEdge invests in Distology

GP is investing from its ТЃ120m SME Fund, which held a final close in July 2018

Download the March 2021 issue of Unquote

The latest issue of the Unquote magazine is now available to our subscribers

Virgin Wines floats in £110m IPO, Connection reaps 7.6x

Mobeus remains invested in the business, while Connection makes a full exit

No need to panic about high dry powder as PE market comes roaring back, says Bain

Appetite remains high for deal-making and exits, according to Bain & Companyтs 2021 Global Private Equity Report

France: strong deals pipeline fuels high average entry multiple

Sponsors fight tooth and nail for prized assets in defensive sectors such as healthcare, higher education and financial services