How UK PE buyouts soared ahead of 2021 Budget

The 2021 UK budget eventually spared investors and business owners from an expected capital gains tax hike; but the very rumours of it likely played a significant role in the recovery of buyout dealflow from late Q4 onward. Greg Gille examines the pre-budget buyout activity

Much ado about nothing? The UK investment community – as well as thousands of entrepreneurs and business owners – were awaiting the 2021 budget delivered by UK chancellor Rishi Sunak on 3 March with bated breath. The fear of a rise in capital gains tax (CGT) rates, widely mooted as a main avenue to help balance the books following unprecedented spending amid the coronavirus crisis, was the talk of most meetings within the PE community from the autumn onward.

Ultimately, CGT did not get a mention during the budget announcement (unlike corporation tax, which could become another headache for PE as the 2023 implementation deadline looms), sparing investors a tax raid into carried interest.

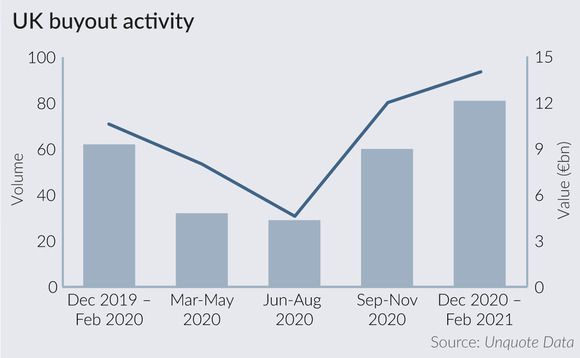

Nevertheless, the rumour mill alone was sufficient to play a part in driving a notable uptick in deal-doing from December onwards, as Unquote Data shows.

Between December and the end of February, the UK was home to 81 buyouts worth a combined £14bn, against 62 deals for a total of £10.6bn in the same period in 2019/20. The aggregate value hike was mostly driven by a handful of mega-deals, such as Bourne Leisure and Advance Pharma, which are unlikely to have been influenced by tax considerations. But the volume increase is notable, with the amount of dealflow in the past three months being significantly higher than in any other December-February period for the past five years, according to Unquote Data.

There is certainly anecdotal evidence that a CGT hike would have strongly deterred the sale of family- and management-owned businesses from April onwards, prompting quick progress on processes for primary deals, as well as MBOs, as previously reported by both Unquote and sister publication Mergermarket.

A GP that finalised two deals across February told Unquote recently: "We definitely pushed through to make sure both deals would come through before the budget announcement."

However, it is difficult to establish a firm causation between the CGT threat and the scale of the uptick, given the unprecendented circumstances that blighted 2020. The amount of pent-up investment appetite from UK PE houses was significant in the latter half of the year, as most processes stopped dead in their tracks in Q2. Again, Unquote Data shows how investment activity rebounded as early as the late summer, with dealflow virtually doubling between the June-August and September-November periods.

It remains to be seen whether the bounce-back will taper off now that a potential CGT rate increase has been kicked into the long grass, with several market participants with whom Unquote at the end of 2020 mentioning they were expecting a quieter Q2 following the pre-budget frenzy. On the flipside, the rapidly improving coronavirus outlook in the UK, and the prospect of an end to lockdown in the coming weeks, could continue to spur deal-doing as 2021 progresses.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds