Quantifying PE's appetite for recurring revenue models

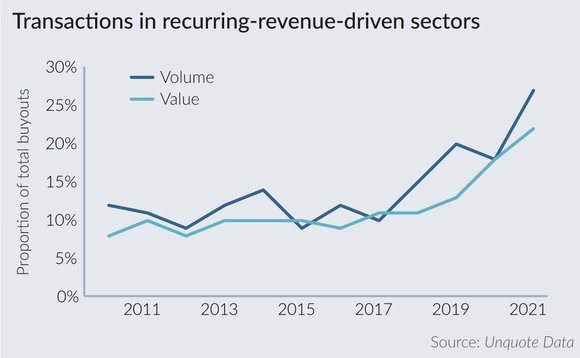

Sectors where recurring revenue models are predominant have been home to 22% of all European buyouts so far in 2021, against just 8% a decade ago, Unquote Data shows.

GPs across Europe have targeted businesses with recurring revenues for some years now. Many an investor has mentioned recurring revenues as a part of their investment theses, such as Cinven, when it acquired security alarm systems company Pronet Güvenlik in 2012; or Invision, with its acquisition of disinfectant maker Dr Deppe in 2017.

This focus has only intensified through the pandemic, as dealflow has shown clear signs of an increasing flight to quality – these businesses have attracted yet more attention, with processes growing ever more competitive and valuations rising.

While not a perfect proxy to track these types of businesses exclusively, the volume of investments in 10 sectors that typically enjoy recurring revenues – such as software, telecommunications and insurance brokers* – has grown as both a share of total investments and in absolute terms, Unquote Data shows: these investments made up 16% of all investments in Europe in 2010, and that figure rose to 38% in 2020.

Data surrounding buyouts alone illustrates the same trend. Buyouts in sectors where recurring revenue models are predominant made up 8% of European volume in 2010, with that figure rising to 18% in 2020. In 2021 to date, these sectors have been home to 22% of all European buyouts.

The aggregate value of these deals also illustrates a dramatic increase, from just 12% of all aggregate value in 2010, to 27% to date in 2021. This reflects not only an increase in deal volume, but also the higher valuations ascribed to these types of businesses – whether through the maturation of such assets throughout the past decade or higher entry multiples.

"High-growth software companies that have really soared in value are pulling up the overall average [entry multiple]," says Oliver Haarmann, a founding partner at Searchlight Capital Partners. "We are investing in recurring revenue businesses more in business services and communications, where we haven't seen such a dramatic increase as 8x, but we have seen an increase in valuations."

* Full list of sectors included in this analysis: alternative electricity, asset managers, fixed-line telecommunications, full-line insurance, insurance brokers, life insurance, mobile telecommunications, mortgage finance, reinsurance, software

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds