Exclusive

Nauta Tech Invest V holds €120m first close

Fund deploys tickets of тЌ1-5m in seed and series-A rounds to support European B2B SaaS startups

Forbion holds first close for Growth Opportunities Fund

New strategy focuses on pre-IPO capital and capital for undervalued listed life sciences companies

DACH fundraising update: H2 2020 pipeline

Although the coronavirus pandemic has set back plans for many GPs, a number of buyout and venture vehicles are on the road in the DACH region

Wise Equity buys Fimo from IGI

This is the first deal inked by the GP via Wisequity V, which closed on its €260m hard-cap in July 2019

CVC hits €21.3bn close for eighth buyout fund

Fund invests equity tickets in the range of тЌ200m-1bn in North American and European companies

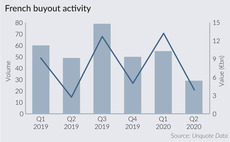

Lockdown impact derails French buyout momentum

Even as France is now moving on, the uncertain road ahead is threatening to undo months of improving activity and market sentiment

Aldea Ventures launches €150m fund-of-funds

VC house expects to hold a €35-45m first close by the end of July and a final close in around one year

M&A wave incoming in 2021, says Edmond de Rothschild CIO

Investment bank's H2 2020 outlook also emphasises continuing macroeconomic uncertainty, and singles out healthcare and data assets as winners

Alcedo to launch €230m fifth fund

Alcedo V will target Italian companies with high-growth potential and an export-orientated approach

Kennet V closes on €223m

Registered in February 2018, the fund's original target was тЌ200m, with a hard-cap of тЌ250m

Equinox closes third fund on €360m

Equinox III targets Italian companies operating in the food, retail, technology and healthcare sectors

Elysian III holds first close on £270m

Domiciled in the UK as a UK limited partnership, the fund has a target of ТЃ300m

GP Profile: Genesis Capital

Managing partner Ondřej Vičar discusses the launch of the firm's latest fund, as well as portfolio management and investing during the coronavirus pandemic

MVI holds first close on MVI Fund II on SEK 688m

Small-cap GP is expected to hold a final close in autumn this year

Unigestion announces closes for Secondary V and Direct II

Secondary V has held a first close on €228m, while Direct II held a third close on €375m

CBPE X nears final close towards £525m target

CBPE X is likely to target UK-based companies with enterprise values of ТЃ25-150m

Buy-and-build: 3i's five-step strategy

Pete Wilson, partner and head of UK private equity at 3i, outlines some key considerations for executing successful bolt-on acquisitions

Nordic e-commerce confident "silver krona" uplift will persevere

Lockdowns have т out of necessity т introduced a new age group to online shopping, boosting prospects for several PE-backed assets

Cimbria acquires Danish software company APX10

Cimbria Nord buys the two-year-old business from Danish organisation Hedelskabet

Italian PE: an opportunity in crisis

The latest edition of Gatti Pavesi Bianchi's series on the Italian private equity and M&A markets is now available to download

Connect Ventures closes $80m seed fund

Fund deploys capital in companies operating across all B2B and consumer software segments

Ufenau buys majority stake in Matrix Technology

Deal is Ufenau's second in the IT service sector in 2020, following its investment in Ikor in April

DACH venture capital looks for a new normal

Although dealflow in the DACH VC market has remained fairly strong, deals have shrunk in average size, and uncertainty lingers

Clessidra to launch €600m fourth fund

Fund will follow the same strategy as its predecessor, Clessidra Capital Partners III