Exclusive

Tenzing closes second fund on £400m

Fund had a target of ТЃ350m with a hard-cap of ТЃ400m and was raised in nine weeks

SwanCap nears final close for latest fund

SwanCap's private equity co-investment fund expects to close 20% above its €250m target

RJD to invest up to £12.75m in Improve

Improve most recently reported revenue and adjusted EBITDA of ТЃ10.1m and ТЃ1.7m respectively

Video: Cambridge Associates' Marcandalli on impact investing moving centre stage

In a new instalment of Unquote's Lockdown series, Annachiara Marcandalli explains why it is unlikely that coronavirus will sideline impact investing

Sherpa Special Situations III closes on €120m

Fund targets distressed companies based in Iberia and active across a wide variety of sectors

Piper to launch next fund in 2021

Managing partner Chris Curry told Unquote the fund is expected to target ТЃ150-175m

Buy-and-building through the storm

Bolt-ons remain one way of deploying capital and building value, but a tough financing market and pricing mismatches make for a challenging landscape

From PE darling to hard-hit sector: gyms face uncertain post-covid future

As gyms and fitness clubs across Europe gear up to welcome back consumers, Unquote explores their tricky path out of lockdown

Reputational risk, early secondaries help assuage LP default fears

GPs that recently raised are the ones potentially more at risk, but market sources agree widespread defaults would be far-fetched

Providence in single-asset restructuring for HSE24

GP bought a majority stake in the shopping channel operator from Ardian in 2012 via its sixth fund

EQT sells credit business to Bridgepoint

There were five or six bidders in the early stages of the sale auction, including Schroders

Hoxton closes second fund on almost $100m

Hoxton Ventures II has a 30% carry rate with a 2.5% management fee and no hurdle

Tikehau to buy stake in Euro Group

Tikehau is investing in the energy transformation sector via its T2 Energy Transition Fund

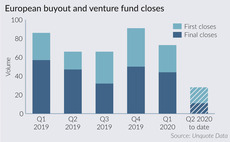

European fund closes slump by 42% amid lockdown

Unquote recorded 44 first or final closes of European PE funds between March and May, a 42% drop on the three-month average seen across 2019

Fly Ventures holds final close for second fund on €53m

Berlin-based VC will continue its focus on seed investments in enterprise software and "deeptech"

Corten closes debut fund on €392m

Corten began raising in January 2019, thus avoiding potential delays in the current market

CapMan to launch first Special Situations fund after summer

Nordic private equity firm CapMan has launched CapMan Special Situations to focus on turnarounds.Т

Gradiente buys three companies, creates Argos Surface

GP deploys capital from Gradiente II, which held a final close on its €135m hard-cap in 2019

Ubi Banca buys stake in Green Arrow Capital

This is the first financial investor that has entered the capital of the firm, owned by its founding partners

Secondaries players weigh up risk and rewards of "ring-fencing" deals

GP-led transactions isolating assets hardest hit by the Covid-19 crisis could appeal to adventurous secondaries players, but challenges abound

Black Toro exits steel producer Irestal

Deal ends a five-year holding period for Black Toro, which boosted the company's growth and expansion

VC Profile: Apex Ventures

Apex's digital-health-focused second fund is targeting €50m following a Q1 2020 first close

Cerea to launch third buyout fund

Cerea also plans to launch its fourth mezzanine vehicle with a тЌ250-275m target next month

Video: CPPIB's Delaney Brown on improved LP/GP relations

In the fourth of Unquote's Lockdown series, Delaney Brown, managing director of CPPIB, discusses improved GP/LP relations since lockdown began