Exclusive

MCH buys minority stake in Prosur

GP is currently investing via MCH Iberian Capital Fund V, which held a €200m first close in April 2020

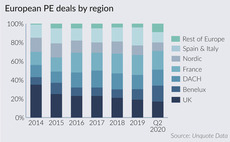

DACH buyout market weathers Covid-19 impact, UK and France suffer

Germany emerged as the busiest region in Europe in Q2, albeit with a low volume and aggregate value of deals by historical standards

Programma 102 closes on €100m

VC will launch a new vehicle by the end of the year, with a тЌ100m target, to focus on complementary asset classes

Unquote Private Equity Podcast: Calling tech support

This week, the Unquote Podcast talks all things technology with Intuitus chief commercial officer Adrian Astley Jones

Fashion victims: GPs face a tough year in the clothing & accessories sector

Unquote explores dealflow expectations and potential silver linings for the segment, which has been one of the hardest hit by the pandemic

Star Capital buys Gamma

GP invests in the company via Star IV Private Equity Fund, which closed on its €140m hard-cap in May 2020

VC Profile: Edge Investments

As the firm begins raising its second fund, chief IR officer David Fisher discusses the current portfolio, LP sentiment and the creative economy

2011-vintage funds: what is still in Nordic portfolios

Unquote and Mergermarket round up a selection of assets still held in 2011-vintage funds managed by Nordic GPs

PE exits hit decade low in Q2

Volume of exits by PE players across Europe fell by 43% year-on-year in Q2 2020 as the coronavirus crisis took hold, according to Unquote Data

GP Profile: Emeram Capital Partners

DACH-focused GP anticipates the launch of its second fund following a portfolio assessment and digital AGM

Virtual Briefing: ESG and rebalancing through secondaries

Palico's Woolston Commons, Cambridge Associates' Varco and Unigestion's Newsome discuss whether the current crisis will lead to an ESG rethink

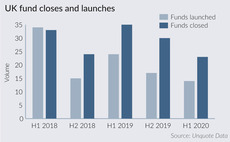

UK fundraising update: pausing for breath

A number of GPs that closed more than three years ago have delayed fresh fundraises, or have altogether decided to explore new options

Market sentiment improving but dealflow likely to remain bifurcated – Baird

Baird MDs Vinay Ghai and Paul Bail discuss deal-making amid the pandemic and emerging trends for the months ahead

Fund Profile: Ardian Secondary Fund VIII

Ardian discusses with Unquote its secondaries activity and outlook on market trends amid the pandemic

EQT sells stake in IFS to TA Associates in €3bn deal

Stake owned by EQT is transferred from EQT VII to its successor funds EQT VIII and EQT IX

Munich Private Equity closes third buyout fund-of-funds

Mid-cap buyout-focused fund-of-funds closed on тЌ162m and has made 14 of its 20 planned investments

Unquote Private Equity Podcast: Fundraising engine stalls

This week, the Unquote Podcast examines the fundraising market amid the challenges of Covid-19

Wise buys tires specialist Vittoria

This is the second deal inked by the GP via Wisequity V, which closed on its €260m hard-cap in July 2019

Download the July/August 2020 issue of Unquote

The latest issue of the Unquote magazine is now available to our subscribers, with some added interactive features

Eir Ventures holds first close on €76m for life sciences fund

VC firm will invest in opportunities in new therapies, medical technology and digital health

Borromin's ProFagus completes refinancing

Charcoal and natural additives company saw final bids from two banks and one direct lender

HIG Capital launches HIG European Capital Partners III

Fund will invest in buyouts, recapitalisations and carve-outs of both profitable and underperforming businesses

Moira invests in logistics operator Goi

Moira intends to support the company's growth and expansion both in Spain and internationally

LP Profile: CPP Investments

Unquote picks out key takeaways from CPPI’s latest annual report, and hears from head of PE funds Delaney Brown about the Canadian LP's strategy