Exclusive

Main Capital collects €535m for sixth software buyout fund

Buyout fund should hit its €564m hard-cap in January 2020, Unquote understands

Minority investing gains traction in southern Europe

Abundance of dry powder and expected downturn have pushed GPs towards experimenting with more diversified ways of deploying capital

LP Profile: EQ Asset Management

Head of private equity Staffan Jåfs discusses the organisation's views on PE opportunities and its fundraising plans

Suma holds €65m first close for second growth fund

Fund invests in Spanish companies with high-growth potential and generating EBITDA of at least €2m

Private wealth to increase allocation to private equity

High-net-worth individuals and family offices are hunting for yield, concerned about low interest rates and market volatility

Poland's MCI gearing up for €400m maiden closed-ended fund

Vehicle will keep to MCI's strategy of backing buyouts of mid-cap technology businesses in the CEE region

Green Arrow buys Poplast from EOS

Green Arrow invests via its third fund, which held a final close on €230.6m in September 2018

EQ targets first close for two PE funds by January 2020

One fund-of-funds will focus on European primaries, and the other on the secondaries market

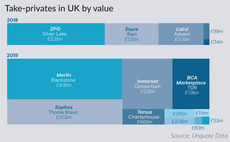

UK-focused GPs getting creative with buyout sourcing

In 2019, 10 take-privates have been agreed in the UK and Ireland to date, up from five in 2018

French buyout fundraising soars in 2019

Mid-market and large-cap fundraising pipeline for 2020 also looks promising, but the market remains bifurcated

Xenon creates leather production group in Italy

GP invests via Xenon Private Equity VII, which held a final close on €300m in November 2019

European biotech flourishes as US and Asian capital pours in

Attracted by a buoyant industry with a rich pipeline, numerous US and Asian players have entered the market

Dutch PE wrestling with gender diversity

Dutch GPs are lagging behind their British counterparts in terms of gender diversity, with women making up only 14% of Dutch PE professionals

Xenon acquires Impresoft

GP deploys capital from its seventh fund, which held a final close on €300m in November 2019

GP Profile: DeA Capital

DeA's diversified offering across multiple asset classes reached €12bn in AUM in 2019

CIC Private Debt closes CIC Debt Fund 3 on €530m

CIC is also fundraising for CIC Mezzanine & Unitranche 5, which launched in September and held a first closing on €150m

Fonds Industries et Technologies II to hold final close in H1

Fund, which backs B2B industrial companies, has a €100m target and a €120m hard-cap

EQT gears up for ninth fund launch

Private equity firm registered several EQT IX vehicles in Luxembourg on 21 November

Investindustrial closes seventh buyout fund on €3.75bn

Fund targets European companies operating in the consumer, industrial and healthcare services sectors

H2 Equity Partners buys Mill Panel

H2 will help the Dutch wooden exterior door panels specialist expand internationally

Mid-market stays loyal to English limited partnership

Luxembourg structures may have their proponents, but the Brexit drama does not seem to have dented the appeal of the English partnership

Warburg Pincus Global Growth Fund raises $14.8bn

Fund targets companies operating in a wide range of sectors and deploys tickets in the $50-500m range

Warburg Pincus sells Accelya to Vista Equity Partners

First investment made by Vista via its permanent fund, Vista Equity Partners Perennial

MMC Ventures holds final close for Scale Up Fund on £100m

Bluetower Associates acted as placement agent and Osborne Clarke provided legal advice