Germany

Creathor et al. invest in Hojoki

Creathor Ventures and Kizoo Technology Capital have invested in German software start-up Hojoki.

DBAG increases Homag stake

Deutsche Beteiligungs AG (DBAG) has increased its stake in listed German portfolio company Homag Group AG from 33.1% to 39.5%.

Odewald & Compagnie sells mateco stake to TVH

Odewald & Compagnie (O&C) has sold its stake in German aerial platform provider mateco Gruppe to Belgian trade buyer TVH.

Silver Lake buys friedola Tech stake from WHEB

Silver Lake Partners has taken over WHEB Partners' majority stake in German recycled plastics processor friedola Tech, through its energy investment initiative Silver Lake Kraftwerk.

DBAG acquires Heytex Bramsche from NORD Holding

Deutsche Beteiligungs AG (DBAG) has acquired Heytex Bramsche, a German manufacturer of print media and technical textiles, in an SBO from NORD Holding.

Mangrove backs HTGF's ezeep

Mangrove Capital Partners has backed German software start-up ezeep, a portfolio company of High-Tech Gründerfonds (HTGF).

Trade buyer caution forcing GPs down SBO route

Secondary buyouts

XAnge and Astutia invest in Pactas

XAnge Private Equity and Astutia Ventures have invested in German e-invoicing specialist Pactas.

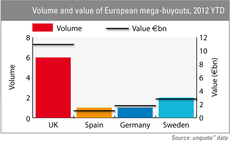

UK mega-buyouts worth more than €10bn this year

In defiance of problems on the continent, the UK has seen a surge in mega-buyouts this year, topped off with the recent acquisition of Annington Homes for ТЃ3.2bn.

HTGF et al. back InnoCyte

High-Tech Gründerfonds (HTGF), the Mittelständische Beteiligungsgesellschaft (MBG) and Fraunhofer Venture have invested a six-figure sum in German medical device company InnoCyte.

Herkules Capital's Pronova BioPharma receives takeover bid

Herkules Capital's Norwegian portfolio company Pronova BioPharma has received a voluntary cash offer from German chemicals company BASF SE.

Charterhouse to sell Ista

Charterhouse Capital Partners and CVC Capital Partners are looking to sell German energy-metering business Ista International for more than €3bn, having already attracted staple financing offers of €2bn from banks, according to reports.

AEA and Teachers' Private Capital buy Dematic from Triton

AEA Investors and Teachers' Private Capital, the private equity arm of the Canadian Teachers Pension Plan, have bought German logistics business Dematic in an SBO from Triton.

Blackstone divests Deutsche Telekom stake

Blackstone has sold around 1.5% of its 4.5% stake in German telecommunications giant Deutsche Telekom AG for an estimated €561m, according to reports.

HTGF et al. back GeneQuine Biotherapeutics

High-Tech Gründerfonds (HTGF) and Innovationsstarter Fonds Hamburg have made a seven-figure seed investment in Hamburg-based biotech company GeneQuine Biotherapeutics.

DACH unquote" November 2012

Last month Germany’s former finance minister Peer Steinbrueck advocated a tough stance on private equity, saying banks should be banned from lending to private equity funds.

HTGF et al. back Cysal

High-Tech Gründerfonds (HTGF) and eCapital entrepreneurial Partners AG's vehicle Gründerfonds Münsterland have invested in German biotech business Cysal.

Kennet leads $15m series-B round for Trademob

Kennet Partners, High-Tech Gründerfonds (HTGF) and Tengelmann Ventures have invested $15m in German mobile applications platform Trademob, according to reports.

Equistone buys Sunrise Medical Mobility from Vestar

Equistone Partners Europe has agreed to buy Sunrise Medical Mobility from Vestar Capital Partners.

HTGF et al. invest in Synapticon

High-Tech Gründerfonds (HTGF), Seedfonds Baden-Wuerttemberg (SFBW) and private investor Günter Lang have invested €1m in German robotics company Synapticon.

Avedon Capital Partners backs Seebach MBO

Avedon Capital Partners has acquired German filtration specialist Seebach together with the company's management.

KKR and Permira to sell Nordic business for up to €1.5bn

Two private equity firms and a trade player are in talks with German PE-backed broadcaster ProSiebenSat.1 Media regarding the acquisition of its Nordic unit т a deal that could fetch up to тЌ1.5bn, according to reports.

DACH leads quiet Europe in Q3

DACH on top

DACH fundraising

The Q3 2012 unquote” Private Equity Barometer revealed DACH leads Europe’s buyout tables by value for the three months to end September, with Germany leading the pack.