IK Investment Partners

IK Investment-backed Eres expected to hit the auction block by 2024

French employee savings distribution and management firm could be valued at a few hundred million euros

IK-backed Klingel bidder ELOS Medtech frontrunner in late-stage auction

German medical equipment firm also drew sponsor interest, with some dropping out due to valuation expectations

Egeria to exit GoodLife Foods in SBO to IK Partners

Acquisition of Dutch frozen snack maker marks 13th investment from IK IX Fund

Aliter Capital to exit Ipsum in sale to IK Partners

Deal for utilities and infrastructure maintenance provider is third exit from GPтs 2017 vintage fund

IK Partners mulls mid-term Southern European expansion

Spain, Portugal and Italy considered for future platform deals as the GPтs portfolio companies strengthen their foothold in the region

The Bolt-Ons Digest – 26 January 2023

Unquoteтs selection of the latest add-ons, with ICG's Circet, Five Arrows' Mintec, Carlyle's Jagex, and more

IK readies Swedish biotech group Mabtech for exit

Jefferies hired as sellside advisor; dual-track process for potential sale or IPO considered

IK to exit Quanos in sale to Keensight Capital

New owner plans to grow Germany-based software developer organically and through M&A

IK exits Studienkreis in sale to edtech unicorn GoStudent

German centre-based tutoring provider will operate independently and under its current management while synergies with new owner are identified

IK Partners buys Plus que Pro

French B2B and B2C construction and business service provider platform will be co-controlled by IK and the founders

Ardian exits Unither to GIC, IK-led consortium

Existing investors Keensight and Parquest to remain in share capital alongside company's management

Oakley Capital to partially exit Wishcard to IK, EMZ

Sale of German gift cards group sees founding management regaining majority position

Doxx owner pulls process despite solid bids from private equity players

Alantra-led sale process for the German healthcare staffing platform had lasted around six months

IK Partners prepares Quanos exit, Raymond James advises

Digital documents and business software provider was formed by IK via a three-company merger in 2020

IK Partners readies Nomios for upcoming sale process

Bank of America will advise on the auction for the Dutch IT services group, formerly known as Infradata

IK Partners in exclusivity to sell Exxelia to US trade

Aerospace electronic components group to be acquired by HEICO Corporation for EUR 453m in cash

IK to sell Linxis Group to Hillenbrand for EUR 572m

Agreed sale of packaging machines group to US-based industrial buyer set to complete by year-end

Equistone, IK invest in PE-backed Safic-Alcan

Paris-headquartered speciality chemical provider’s existing shareholders include EMZ and Sagard

IK pauses Ampelmann auction amid macro concerns

Buyer interest dampened by Dutch offshore access systems developer's exposure to Russia

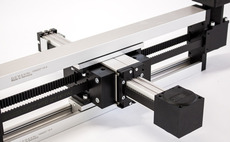

IK exits Bahr Modultechnik in EUR 98m trade sale

IK acquired the modular electric linear motion systems producer in 2018 via its Small Cap strategy

Perusa to exit Müpro in SBO to IK

Management of the German industrial fixings supplier will reinvest with a minority stake

IK to sell 2Connect in SBO to Rivean

Management of the Dutch cable and connectors manufacturer will reinvest in the transaction

The Bolt-Ons Digest – 28 April 2022

Unquote’s selection of the latest add-ons featuring Capiton’s Wundex, EQT’s Cerba Healthcare, Thoma Bravo's Sophos, and more

LGT sells Batisanté to IK Partners

New owner investing via Fund IX; looks to grow the company organically