Italy

Assietta buys 87% stake in MMB Costruzioni Meccaniche

Ape III is now 60% invested and aims to deploy its last acquisition by May 2017

Assietta launches €60m fourth fund

Vehicle has a six-year lifespan and aims to raise up to €70m

P101 leads €3.8m round for Tannico

Italian GP led a previous €1m funding round in May 2015

Alcedo buys 47% of Stranich from Assietta for €10m

Italian GP has acquired a 49% stake in the target company from Assietta Private Equity

P101, 360 lead €1m round for Milkman

Backers include Italian VC firms P101 and 360 Capital Partners, and angel investor Mike Brennen

Allianz Ventures leads series-B round for MoneyFarm

Allianz will secure a minority stake, and a representative will join the management board

Capvis buys majority stake in Gotha

Deal marks the third investment in northern Italy for the Baar-based GP

Syntegra and Index exit Moleskine

Delisting after three years values the equity of Moleskine at €506m

Alcedo buys 55% of Italy's Nahrin Swiss Care

Deal marks the second acquisition from the GP’s 2015-vintage Alcedo IV fund

Alpha acquires majority stake in Mios Elettronica

As part of the deal, existing shareholders will retain a minority stake in the business

Investindustrial's B&B acquires 70% stake in Arclinea

Acquisition marks the first step in the GP’s expansion plan for its portfolio company

Italmobiliare nears full Clessidra ownership

GP appoints Pesenti as chair and Fera as CEO as part of the acquisition

Treating Europe's healthcare malaise

With Europe facing an ageing population and a sharp rise in long-term chronic illnesses, unquote" investigates private equity's role in solving the continent's healthcare conundrum

Doctor's orders: Addressing Europe's healthcare shortfall

France, Germany and southern Europe are emerging as the continent's most active markets for PE investment in healthcare provision

Deal in Focus: HIG divests maiden Italian education buyout

An in-depth look at the firm’s first private equity investment in the education sector in Italy

Dentons hires Abbas as partner for Rome office

Appointment follows the opening of the firm's Rome office in July 2016

HIG buys 90% stake in Italian non-wovens producer Texbond

Deal marks the GP’s second investment in the Italian market

Innogest, Panakès lead €4.2m series-A for Seventeen

Funding round will allow the company to reach the commercialisation stage for its product

Ver Capital holds first closing on €50m for debt fund

With a €150m target and €200m hard-cap, the fund expects to hold a second closing in November

Primomiglio holds €30m first close for Barcamper fund

GP has raised capital from Fondo Italiano, Banca Sella, Reale Mutua Assicurazioni and others

Afinum's Lomb Art bolts on Archimede

Deal follows the company’s MBO backed by Afinum in October 2015

FIEE holds first close on €86m

New Italian GP will exclusively target companies operating in the energy efficiency sector

HgCapital acquires 82% of Mobyt for €26.1m

Transaction gives the SMS marketing and advertising company a market cap of €31.9m

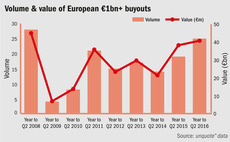

Southern Europe leads renaissance of billion-euro club

Dealflow in the тЌ1bn+ buyout segment reached an eight-year high across Europe in the 12 months to Q2 2016