Kartesia

Kartesia's management to take majority stake in Flexam

Pan-European capital solutions provider’s partnership with France-based fund manager will add real-asset financing to its offering

YFM sells FourNet stake to Palatine for 6x return

YFM invested ТЃ9m for a minority stake in the cloud contact centre business in 2017

Kartesia Credit Opportunities Fund V hits €1.5bn hard-cap

Fund provides flexible and bespoke credit solutions to lower-mid-market European companies

Kartesia Senior Opportunities I holds €1bn final close

Fund provides senior financing to European small and medium-sized companies with strong credit profiles

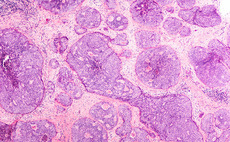

Kartesia takes control of ADL Biopharma

Company's board of directors is reduced to three seats and Ignacio Urbelz is appointed as new CEO

Kartesia's International Cookware bolts on Duralex

International Cookware plans to invest around €17m by 2024 to innovate Duralex's business and improve productivity

Apse-backed Kallidus acquires Sapling

This is Kallidus's second acquisition following the purchase of Engage in Learning in March 2020

Kartesia in €32m refinancing for Enterprise-backed Nu-Med

Enterprise Investors acquired a minority stake in the oncology company in 2013

Kartesia injects €75m into HeadFirst

Kartesia backs the recruitment company via its KCO IV and KCO V funds

UK Fundraising Pipeline - Q4 2020

Unquote rounds up the most notable fundraises currently ongoing in the French market across the buyout, venture and secondaries spaces

Kartesia carves out ADL Biopharma from Black Toro's ADL Bionatur

Deal includes a new debt tranche of €5m made available by Kartesia at closing and a capital increase of at least €10m

Nexxus Iberia buys STM

GP invests in the company via Nexxus Iberia Private Equity Fund I, which closed on €170m in February 2020

Kartesia backs £26m refinancing for BGF-backed Clearway

Debt has been invested from Kartesia Senior Opportunities I, marking the fundтs first UK investment

Kartesia buys International Cookware from Aurora Resurgence

Sale ends a six-year holding period for Aurora, which acquired the company from Arc International Group

Kartesia expands DACH presence via new Munich office

Firm's Munich expansion incorporates new hire Giuseppe Mirante, previously of HIG Capital

Kartesia hires Mirante to expand in DACH region

Mirante joins from HIG Bayside and previously worked at BNP Paribas, Morgan Stanley and Rhône Capital

Oddo BHF hires Kartesia's Geiger as head of private debt

Oddo's first offering in the asset class will focus on German senior secured debt funds

Kartesia closes latest fund on €870m hard-cap

Alternative lender says it was on the road for nine months, raising тЌ360m more than for Fund III