Luxembourg

GPs hungry for Benelux's food and beverages sector

From 2014 to date, Benelux has surpassed all other European regions in terms of large-cap buyouts in the food sector

Capital Croissance backs Emresa SBO

After seven years of ownership, Siparex and Re-sources sell Luxembourg-based Emresa

Vesalius holds final close on €120m

Vehicle was launched in March 2017 and held a first close on €65m towards its €150m target in 2017

Triton exits steel waste recycling company Befesa

Sale ends a six-year holding period for the GP, which bought Befesa from recycling company Abengoa

Pamplona hires Benelux head

Tensen will be responsible for driving new investment opportunities and value creation in the region

Triton-backed Eqos acquires Bilfinger FRB

Eqos is a Triton Fund IV portfolio company with revenues of €246m and 1,500 employees

Benelux trade deals surged in 2018

Exits to strategic buyers accounted for 56% of all divestments, with the volume of such deals increasing by 68% year-on-year

L-Gam closes second fund on €772m

Launched in mid-2018 with a €650-750m target, L-Gam II held its final close in December

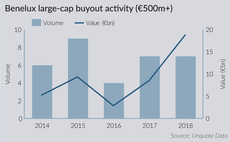

Large-cap deals turbo-boost Benelux buyout market

Deals valued at more than €500m reached a post-crisis peak last year, even setting aside Carlyle's €10bn AkzoNobel carve-out

Bridgepoint acquires Miya from Arison Investments

Miya's acquisition is the first investment made by Bridgepoint's €5.7bn Europe VI fund

Benelux venture fundraising outpaces buyout counterpart

Last year’s €887m committed to venture funds is the second highest ever seen in the region, after 2016’s record of €1.03bn

Mezzanine Management closes fourth fund on €264m

Central-Europe-focused mezzanine specialist raises its largest ever vehicle, banking on support from local LPs

Corviglia holds first close on $250m

Vehicle was registered in Luxembourg in July 2018 and is targeting a final close on $500m

GP demand remains strong for Luxembourg's RAIFs

Launched two years ago, the fund structure has been well received by the PE community as almost 500 such vehicles have registered in two years

Equistone backs Wallenborn Transports MBO

GP invests in Luxembourg-based Wallenborn Transports while CEO retains a significant stake

VC firms invest $16m in Job Today

Existing investors Mangrove Capital Partners and Accel Ventures also take part

Benelux industrials booming and primed for internationalisation

Sector soars past consumer in terms of aggregate value of H1 buyouts, having historically attracted similar levels of PE backing

Ogier promotes two

Delamarre and Elslander earn promotion to senior associate after joining the firm in 2014 and 2016

Ardian exits Encevo to CSGI HK

Following the deal, Encevo is seeking industrial partnerships such as with CSG, based in Guangzhou

JC Flowers sells OneLife to trade

New group will have a combined AUM of €16.5bn, €5.2bn of which is currently managed by OneLife

OpenGate carves out Gunnebo's France and Benelux operations

Divested divisions include two production sites and the France and Benelux sales companies

Benelux large-cap activity swells in H1

Aggregate value of deals valued at more than €500m is approaching pre-crisis levels, based on H1 2018 figures

SwanCap launches co-investment fund

SwanCap held a final close on тЌ433m for SwanCap Opportunities Fund III in February 2018