Luxembourg

Fremman considers return to market in 2024 following newly closed EUR 1bn debut fundraise

Pan-European GP raised its debut fund during the тmost challengingт period for debut funds in recent years

Stirling Square buys Eurofins Digital Testing for EUR 220m

Mid-market GP is deploying 2020 Fun IV in primary carve-out from French laboratories company

Cinven to sell Tractel to trade for EUR 500m

Exit to Sweden-listed Alimak values safety products specialist at 10.3x EBITDA

Ergon holds EUR 800m final close for Fund V

New EUR 800m fund is almost 40% larger than its EUR 580m, 2018-vintage predecessor

RBS appoints new fund finance director in Luxembourg

Bank appoints Philip Prideaux to drive its Luxembourg funds banking offering

Goodwin hires Ghillemyn

Harry Ghillemyn began his career at Linklaters as a trainee, later being promoted to associate

Foresight opens office in Luxembourg

Luxembourg office will be led by Adela Baho and Jasper Jansen, who have each joined as directors

Archeide launches €50m VC fund

Fund will target Italian startups developing innovative products and applications

Astorg's IQ-EQ buys Conseil Expertise & Synthèse

Add-on is the company's second of 2020, having bought US-based Blue River Partners in March

Inflexion-backed Ocorian acquires Allegro

Luxembourg-based Allegro is Ocorian's first acquisition since its merger with Estera

AKD appoints Leroy and Nesch as partners

Appointments of Leroy and Nesch bring the total number of partners at AKD's Luxembourg office to seven

Oakley sells stake in AtHome to Mayfair

Listed vehicle Oakley Capital Investments reports proceeds of £15m from the sale

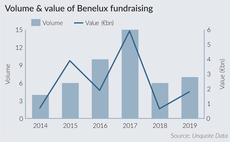

2020 Outlook: Benelux dealflow breaks records as fundraising recovers

While often out of the European private equity limelight on the deal-making side, the Benelux region quietly posted an excellent 2019

PAI Partners to launch €600m mid-market fund

Vehicle will target companies based across Italy, Spain, Germany, France and the Benelux region

3i creates new bioprocessing platform with Cellon acquisition

GP is currently looking for a CEO to sit across the divisions of the new platfom

Luxembourg's IFMs keep up with tech

Luxembourg and its myriad local administrators are working hard to adapt to the technology-driven shake-up of the fund admin space

Mid-market stays loyal to English limited partnership

Luxembourg structures may have their proponents, but the Brexit drama does not seem to have dented the appeal of the English partnership

Benelux biotech and pharma startups attracting larger rounds

Average tickets for early-stage investments have jumped from €13m in 2017, to €20m the year after and €36m this year

Turenne, Euro Capital back Stoll Trucks MBO

Founder sells a majority stake in the trucks and vehicles business to the management team and GPs

Vistra appoints Bouwmeister as PE global sector head

Bouwmeister is promoted from divisional managing director to PE global sector head

Bamboo appoints Milligan as head of diversity

Katherine Milligan previously held roles at the Schwab Foundation for Social Entrepreneurship

Aztec Group strengthens private equity team

Aztec hires Detournay as director, and Khan and Lombardo as associate directors

H1 Review: Large-cap value drives Benelux buyout activity

H1's aggregate value of €11.1bn resulted in a 60% increase on H2 2018, and reveals large-cap activity remains strong in the region

BNY Mellon expands PE capabilities

Robert Burchett-Coates and Greg Kok are appointed as directors based in London and Luxembourg, respectively