Marlborough Partners

Emerging manager Px3 makes first acquisition with carve-out buyout

RhУДne Group spin-out makes inaugural acquisition with Celeros Flow Technologyтs filtration unit buyout

Marlborough founder David Parker joins Axis Arbor

New debt advisory firm was launched last year and notably advised on the Deliveroo IPO

OakNorth Bank provides fund facility to BlueGem

Key investors include Glendower Capital, Blackstone's Strategic Partners and BMO Global Asset Management

Equistone buys Bulgin in £105m deal

Firm scores its fourth carve-out in a month with the purchase from Elektron Technology

Rubicon sells Farsound Aviation to AGIC for £115m

Aviation-focused supply chain management company was reportedly marketed based on ТЃ11.4m EBITDA

Marlborough hires Lloyds' Welsh to lead fund finance efforts

Welsh leaves his role in Lloyds' financial sponsors division after 14 years at the company

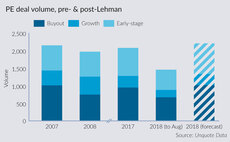

Then and now: European private equity's post-Lehman decade

European PE came to a virtual standstill 10 years ago, but figures show the asset class has all but recovered its pre-crisis appeal

Marlborough opens office in Madrid, hires head of Iberia

PwC's Pedro Manen de Sola-Morales will become managing director and head of Iberia

Equistone sells Travel Counsellors to Vitruvian

Sale follows a three-and-a-half-year tenure and brings to an end proposals to list the travel agent

Bridgepoint's BigHand bolts on DWR

Following the deal, BigHand plans to further develop its software product and bolster its growth

Perfect fit: The evolving craft of fund financing

GPs are tailoring more complex and plentiful fund finance facilities to their advantage

ECB leverage guidelines: casting too wide a net?

Debt advisory firm Marlborough Partners warns that the guidelines, as they stand, could impact deals with standard levels of term debt

European leveraged loans rocket in Q1 on back of favourable terms

Opportunistic recaps and refinancings, with borrowers taking advantage of lower pricing, led to a 140% uptick in loan volume in Q1

Marlborough hires Simpson-Orlebar as senior adviser

Aubrey Simpson-Orlebar joins debt advisory firm Marlborough Partners after leaving Lloyds

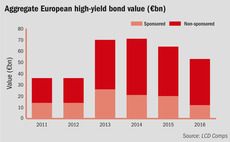

High-yield issuance for PE buyouts hits six-year low

Loan market flexibility and pricing steal the limelight as high-yield market for buyouts raises lowest total since 2010

Debt advisory: Building bridges between sponsors & lenders

Debt advisory role is growing increasingly prevalent in the European mid-market private equity space

UK debt market rebounds in response to lower yields

Debt volumes were up 9% in Q3 2016 as lower yields prompt wave of recaps and refinancings

UK debt volumes drop in Q2 as Brexit puts brakes on issuance

Brexit prospects impacted issuance in the UK in the second quarter, but strong buyout volumes across Europe helped keep loan volumes afloat

Nordic mid-market mezzanine's malaise

Mid-market mezzanine has been all but entirely squeezed out of the Nordic private equity space

Marlborough Partners and STJ Advisors join forces

Firms set up a joint venture to pitch integrated equity and debt services to clients worldwide

Marlborough Partners appoints Metzgen as MD

New recruit will oversee the firm's coverage and execution advisory activity

How private equity is dealing with the debt deluge

Despite jitters in the large-cap space, the European mid-market continues to be flooded with financing options

Debt: borrowing terms improve as competition intensifies

European PE houses set to benefit from increasingly borrower-friendly environment for remainder of 2015

German debt market: a changing landscape

German refinancings are increasingly turning to alternative lenders