Mergermarket

IK Partners prepares Quanos exit, Raymond James advises

Digital documents and business software provider was formed by IK via a three-company merger in 2020

Mid Europa Partners readies software developer Intive for sale

Goldman Sachs will advise on auction for Germany-headquartered company, expected to launch in Q4

Capiton's KD Pharma sale shelved on valuation challenges

Sponsor had been running a dual track process for the Germany-based omega-3 fatty acid manufacturer

DPE preps sale of engineering firm VTU

Deutsche Private Equity acquired a 70% stake in the Austria-based company in 2018

IK Partners readies Nomios for upcoming sale process

Bank of America will advise on the auction for the Dutch IT services group, formerly known as Infradata

Morgan Stanley equity solutions MD departs

Gautier Martin-Regnier has left after nine years at the bank; expected to join sovereign wealth fund

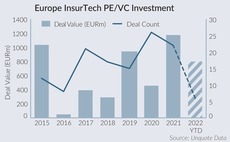

Sidekick spinoffs: Insurtech scale-ups attract PE interest

Investment set to break EUR 1.1bn mark this year as sponsors seek for rising stars

Aliter Capital readies Ipsum for post-summer auction

DC Advisory to lead on sale of UK-based utilities and infrastructure services provider

Deutsche Bank head of EMEA equity-linked departs

Xavier Lagache is no longer in the role after more than a decade; replacement not announced

DBAG prepares Cloudflight for sale launch late this year

GP aims for 20x EBITDA valuation for German IT services and software consultancy

Ergon readies Opseo for exit advised by Goldman Sachs

German outpatient intensive care clinics to be marketed off EUR 60m-70m EBITDA

EQT to target trade players in Kfzteile24 auction

Houlihan Lokey is advising on sale of German car parts e-retailer held in the GP's Mid Market Fund

CBPE in exclusivity to acquire Palatine-backed Veincentre

UK varicose vein treatment clinic was put up for sale in a Grant Thornton-led auction

LDC mandates Houlihan Lokey for MSQ Partners exit

Formal auction for the UK-based marketing communications group has not yet been launched

Charterhouse expected to launch Optima's sale by early 2023

Owner is yet to appoint advisors to guide it on exit of Italian food ingredients producer

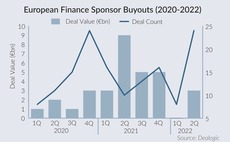

Sponsors brave the storm amid drop in financial services M&A

GP buyouts in the financial services space reached a two-year high in H1 2022 as rising financing costs and a brewing recession cloud the sector's M&A outlook

Bridgepoint picks Macquarie for sale of Cambridge Education Group

Auction of UK-based pathway programme provider slated for late this year, early 2023

Five Arrows-backed A2MAC1 eyes September auction launch

Car benchmarking group could be valued at EUR 1bn in sale likely to attract major tech funds

Bain Capital appoints advisers for Bugaboo exit

Dutch pram maker to hit the M&A pipeline in an auction guided by Baird and Barclays Capital

Hg to launch sale of business messaging group Commify

Moelis-led auction is expected to see the UK-based company marketed off EUR 25m EBITDA

Equistone weighs auction for United Initiators

Evercore is advising on upcoming sale of the Germany-based specialty chemicals supplier

Novum places MMC Studios in continuation fund

New vehicle will allow German GP to complete wind-down of Fund I; DWS Private Equity added as anchor investor

Carlyle closes in on acquisition of water fountain group Ocmis

US sponsor to beat Ambienta-NB Renaissance consortium with EUR 270m offer for Italian asset

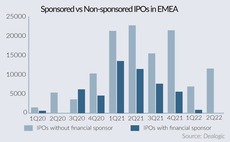

Corporates best placed for autumn IPO window as sponsors sit out

GPs expected to continue to ditch listings in the short term in favour of sale exits, longer holding periods