Netherlands

Cowen Healthcare in €47m extension round for AM-Pharma

Round comprises €23m in equity and a €24m finance facility provided by the European Investment Bank

Gradient, Partech lead a $3m seed round for Kaizo

Former partner at IBM Ventures Christoph Auer-Welsbach joins Kaizo as a co-founder

Jerusalem Venture leads $25m series-C for Pyramid Analytics

Investment brings the total funding raised by Pyramid Analytics to $66.5m

Revo Capital Fund II holds first close on €40m

Domiciled in the Netherlands and structured as a BV, the fund has a 2% management fee

Blackstone to continue preparations to acquire NIBC

Blackstone's offer comprises 995 euro cents per share, including the final dividend of 33 cents

Active Capital buys Delta Coastal Services

GP deploys capital from Active Capital Company Fund IV, which closed on €85m in September 2019

Triton-backed Unica acquires PCT Koudetechniek

Deal is Unica's sixth acquisition under the ownership of Triton

Standard Investment sells Flatfield in SEK 182m deal

Sale ends a six-year holding period for Standard Investment, which owned a majority stake

Main Capital acquires majority stake in WoodWing

Investment will accelerate software development as well as a buy-and-build strategy

Nordian Capital Partners sells Open Line to Capital A

Sale ends a four-year holding period for Nordian, which owned a majority stake in the company

Summit-backed Viroclinics acquires DDL

Bob van Gemen, CEO of Viroclinics Biosciences, will serve as CEO of the combined organisation

Main Capital carves out Exxellence and SMQ from Kune

GP intends to support the new group in developing its product portfolio and expanding its customer base

Gimv invests in AME

Investment in the electronic components manufacturer is part of the GP's Smart Industries platform

Main Capital Partners exits Onguard to trade

GP stands to make a double-digit money multiple from the sale of the credit software company to Visma

CapitalT holds first close for debut fund

VC firm was founded by Janneke Niessen and Eva de Mol, and will target €40m for its first vehicle

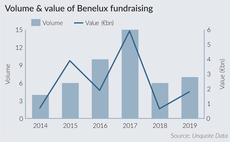

2020 Outlook: Benelux dealflow breaks records as fundraising recovers

While often out of the European private equity limelight on the deal-making side, the Benelux region quietly posted an excellent 2019

Main Capital sells TPSC to PE-backed Symplr

Sale ends a six-year holding period for the GP, which bought TPSC via its €40m Main Capital III fund

Parcom Capital acquires Euramax Coated Products

US-based parent company Omnimax International sold the business to the Netherlands-based GP

Shoe Investments, Knight Venture in €2.75m series-A for Dealroom

Funding will support Dealroom's continued international expansion in Europe and beyond

Cerberus sells Covis Pharma to Apollo

Sale ends a nine-year holding period for the GP, which built Covis through a series of acquisitions

PAI Partners to launch €600m mid-market fund

Vehicle will target companies based across Italy, Spain, Germany, France and the Benelux region

Ergon Capital Partners to back CompaNanny

Belgian GP plans to back the company, according to a document by the Dutch competition authority

OxGreenfield backs Bavak Beveiligingsgroep

Founded in 2019, OxGreenfield backs Dutch companies generating a turnover of up to €50m

Vortex buys Assai Software Services

GP draws equity from Vortex Buyouts II, which closed on €35m in 2017 and is now more than 50% deployed