Sweden

Verdane-backed Wrap sells software arm to trade

Verdane Capital in 2008 acquired a majority stake in the parent company from Swedish business Saab

Triton-backed Assemblin acquires Örestadskyl

GP bought Assemblin in 2015; the company has since acquired two other installation businesses in Sweden

MTIP leads €11m round for Trialbee

MTIP is investing from MTIP Fund II, a vehicle that held a first close in November 2019

Verdane invests in Conscriptor and Max Manus

GP will merge the two companies to form a new healthcare technology group in Scandinavia

Bokio raises €7.4m funding; acquires competitor Red Flag

Merged entity is reportedly valued at between SEK 500m-1bn.

Stirling Square acquires majority stake in Assistansbolaget

Deal is the Stirling Square's third investment from its тЌ950m fourth buyout fund

Axcel holds first close for sixth flagship fund

GP's sixth fund has already raised 77% of the amount raised by its predecessor

Main Capital buys majority stake in health software firm Alfa

Netherlands-based GP paid тЌ15-20m for its stake in the company

CapMan to buy majority stake in Swedish firm PDS Vision

Deal will see minority shareholder Arctos Equity Partners exit the business

LP Profile: Kåpan Pensioner

Mikael Falck, head of alternatives, discusses the Swedish pension fund's appetite and exposure to the asset class

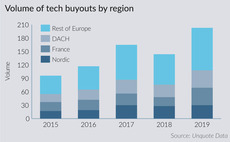

Technology buyouts stall in Nordic region

Technology buyouts have hovered around the 30-per-year mark for three years running now, suggesting a plateau has been reached

Litorina acquires Swedish restaurant chain Sushi Yama

PE house sees potential for 100-150 new restaurants in Sweden alone and is searching for new locations

CapMan exits INR to Dansani

Merged company aims to expand beyond Scandinavia and into markets in central Europe

KKR invests in Oslo-listed Avida Finans

GP buys 9,090,909 shares for NOK 300m and intends to launch a conditional offer for all Avida shares

Kinnevik leads $51.6m round for Mathem

Round also saw participation from AMF, which invested $28.9m

Oxx holds $133m final close for debut fund

Venture fund held a first close on $100m in May 2018 and will focus on B2B software companies

Nordstjernan sells PriceRunner in management buy-back

Nordstjernan had owned PriceRunner since 2016, alongside Nicklas StorУЅkers and KarlтJohan Persson

Consortium in €90m round for Tink

Insight Venture Partners previously led a тЌ56m funding round early last year

Eight Roads et al. in €42.6m series-B for Funnel

Fresh capital will be used to accelerate Funnel's operations in the US and invest in its technical teams

Vendis appoints Riisberg as senior adviser in Nordic region

Christian Riisberg was previously founding partner of Alipes and a board member for various companies

PE-backed Sulo acquires San Sac from Accent

Accent Equity Partners initiated the sale for the waste containerisation company in October 2018

ICG raises €1bn for Mid-Market fund, appoints two MDs

Peter Kirtley and Robin Molvin will support the deployment of ICGтs maiden Mid-Market fund

Bregal buys Iptor with management

Sale process stalled in 2018 and was picked up again in May 2019 by vendor Marlin Equity Partners

Accent Equity buys Global Attractions SPI

Playground equipment producer hopes to expand internationally and broaden its product portfolio