Switzerland

Yellow&Blue et al. back Romo Wind

Yellow&Blue Investment Management, ABB Technology Ventures and b-to-v Partners have invested €4.8m in Swiss wind farm optimisation company Romo Wind, alongside the business's founders.

EdRip and Forbion lead funding for Allecra Therapeutics

Edmond de Rothschild Investment Partners (EdRip) and Forbion Capital Partners have invested in a €15m series-A round for Swiss biotech company Allecra Therapeutics.

Sofinnova backs Auris Medical with CHF 47.1m

French VC Sofinnova Partners has joined US-based Sofinnova Ventures in a CHF 47.1m funding round for Auris Medical.

DACH unquote" April 2013

The German government’s draft proposals for banking reform, based on the Liikanen Report, are seen by many in the private equity industry as yet another threat from legislators, despite the unclear effect it may have on the asset class.

PE-backed Bauwerk Parkett merges with Boen

Zurmont Madison Private Equity and EGS Beteiligungen's Swiss portfolio company Bauwerk Parkett AG has merged with Norway-based Boen AS to form the Bauwerk Boen Group.

DACH unquote" March 2013

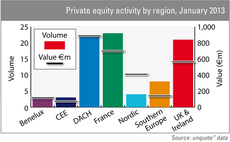

Austria’s private equity scene could be on the verge of a mini-boom as January’s deal activity has already out-stripped the whole of last year’s first quarter.

Partners Group closes Global Value 2011 on €680m

Partners Group has held a final close for Global Value 2011, the third fund in the series, on €680m.

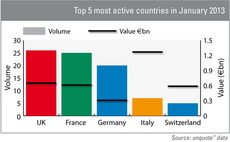

Italy shines in January thanks to CVC mega-buyout

Italy topped Europe's private equity value charts in January, while the UK recorded the most deals, showing both familiar names and outliers starting 2013 on a high.

LGT closes third secondaries fund on $2bn

LGT Capital Partners has held a final close for Crown Global Secondaries III (CGS III) on its $2bn hard-cap.

UK activity falls behind France and DACH

The UK & Ireland private equity market has been overtaken by the French and DACH regions in January according to figures from unquoteт data.

DACH unquote" February 2013

German private equity is poised for a decisive year, awaiting both the implementation of the AIFM Directive and the election of a new chancellor and Bundestag, while struggling against the backdrop of Europe’s worsening economic outlook.

Capvis buys Nicko Tours

Capvis has bought a majority stake in river cruises operator Nicko Tours as part of a succession plan.

Hertfordshire County Council commits £280m to LGT

LGT Capital Partners has received a £280m mandate for its multi-alternatives offering from the British Hertfordshire County Council.

Milestone buys ITX

Milestone Capital Partners has bought Geneva-based intra-group mobility service provider ITX in a management buyout from the company's founders.

Advent to sell shares in airport retailer Dufry

Advent International is understood to be looking to sell 3.9 million shares in listed Swiss airport retailer Dufry, a transaction that could be valued upwards of €350m.

Emerald holds second close for third fund

Switzerland-based Emerald Technology Ventures has held a second close for its third venture fund, Emerald Technology Ventures III.

SK Capital acquires three businesses from Clariant

US-based SK Capital Partners has acquired three businesses from Swiss listed specialty chemicals company Clariant for an equity value of $500m.

Galena Asset Management holds first close on $275m

Trafigura's asset management arm Galena has held a first close of its Private Equity Resource Fund on $275m.

Spark and Highland Capital invest in GetYourGuide

Spark Capital and Highland Capital Partners Europe have invested $14m in German online tour booking company GetYourGuide.

PMV in €34.5m Biocartis series-D round

Flemish VC firm PMV has invested €11m in a €34.5m series-D round for Swiss molecular diagnostics company Biocartis, alongside other existing investors.

Partners Group makes year-end senior management promotions

Partners Group has promoted two partners and eight managing directors to its senior management team globally as part of year-end promotions.

DACH unquote" December 2012/January 2013

Activity in Germany has been slow throughout the year but as the end of summer approached, deals and exits began to surface.

Partners Group closes oversubscribed €2bn secondaries fund

Partners Group has closed its latest private equity secondaries fund at its hard-cap of €2bn before the end of the fundraising period.

Blackstone buys Intertrust for €675m

The Blackstone Group has acquired Dutch tax consultancy Intertrust from Waterland Private Equity for a reported €675m.