Switzerland

Evoco sells Plumettaz to Invision

Evoco bought the cable-laying equipment producer in a six-company portfolio deal in 2015

ArchiMed buys Stragen Pharma

GP is investing via its €1bn Med Platform I, which backs healthcare firms with EVs of at least €100m

LGT closes fifth secondaries fund on $4.5bn hard-cap

GP had a target of raising $3.75-3.80bn for the fund, and is larger than its $2.8bn predecessor

Heubach, SK Capital Partners carve out Clariant Pigments

Carve-out values the company at up to CHF 855m with a CHF 50m earn-out component

Genui invests in Labor Team W

MBI deal sees Genui take a majority stake in the diagnostics lab, investing alongside its management

Apposite Capital acquires 1Med

GP has secured financing for a buy-and-build strategy for the contract research organisation firm

Novo, HBM lead CHF 100m round for Numab

New investors in the round include Forbion, which is participating via its Growth Opportunities fund

Gro-backed Trifork to list in €400m IPO

Planned exit comes six years after software investor Gro Capital invested €6m in Trifork for a 20% stake

Q1 DACH VC and growth deals surpass previous volume high

Deal volume has grown steadily since Q2 2019; aggregate value has also been rising since Q2 2020

CVC leads growth investment in Acronis

Cybersecurity software developer is valued at $2.5bn, compared with $1bn at its last funding round in 2019

Gyrus holds close for Gyrus Investment Program

Program comprises Gyrus Principal Fund and its co-investment Cortex fund; it has a тЌ400m hard-cap

Telemos Capital acquires Mammut

Conzzeta began to explore sale options for the Swiss outdoor clothing and hardware brand in 2019

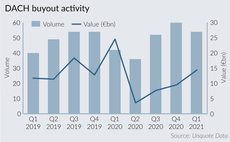

DACH buyouts continue recovery from Q2 2020 low

Both deal volume and value are now back on par with the figures for Q4 2019, prior to the pandemic

Endeavour Vision closes Medtech Growth II on $375m

Fund is 30% larger than its predecessor and will continue to focus on medtech growth investments

Patrimonium hires Mogwitz

Ulrich Mogwitz joins the firm's private equity team from impact investor Prorsum

VCs in $115m round for CeQur

Funding round is the largest ever recorded for a medical equipment company in Switzerland

Klar Partners to acquire ISS Kanal Services

Carve-out is the first DACH-region platform investment from Klar Partners' €600m debut fund

KPS to buy Crown's EMEA tinplate packaging business

European packaging sector buyouts in 2021 already exceed the aggregate value recorded in 2020

MTIP holds first close for second fund

Digital-health-focused growth investor has a hard-cap of тЌ250m and target of тЌ200m for MTIP Fund II

Gyrus Principal Fund to close in Q2 2021

Fund focuses on healthcare, technology and sustainability, and expects to close on its €400m hard-cap

DACH Fundraising Pipeline - Q1 2021

Unquote compiles a roundup of the most notable fundraises ongoing across the DACH market, including Capiton, Afinum, Gyrus, Cipio, and more

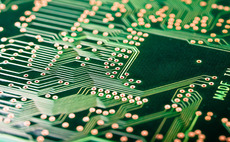

One Equity Partners buys stake in Cicor Group

GP is to acquire a stake in the Switzerland-based circuit board producer from HEB Swiss Investment

Equistone acquires Franke Water Systems

Carve-out comprises kitchen and bathroom fittings businesses Water Systems Commercial Group and KWC

VCs in CHF 15m round for Carvolution

Entrepreneur Franvisco Fernandez, the founder of banking platform Avaloq, leads the round