Top story

UK consumer deals slump as GPs heed Brexit warnings

Strong consumer spending figures in the months following the EU referendum have not translated to increased PE investment in the sector

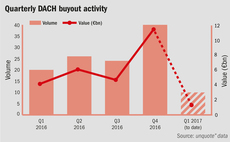

Quiet start to 2017 for DACH buyouts following Q4 flurry

Number of large German deals saw the DACH region outpace its European neighbours at the end of 2016, in terms of aggregate value

Deal in Focus: Ambienta reaps €330m on IPC trade sale

Trade sale of cleaning machine manufacturer marks the GP's largest exit since its foundation in 2007

Debt advisory: Holding the cards in sell-side processes

Advisory firms often hold all the cards when pre-emptively introducing potential lenders to future sales processes

Debt advisory: Building bridges between sponsors & lenders

Debt advisory role is growing increasingly prevalent in the European mid-market private equity space

Nordic onshoring remains elusive without political assurances

Tax transparency in the Nordic region will only improve slowly without political assurances

New government may jeopardise Romanian progress

Results of December election follows year of record Romanian M&A activity and strong PE performance

In Profile: Apax Partners

GP closed its ninth fund in 2016 on its hard-cap of $9bn and recently made high-profile exits including the 2015 IPO of Auto Trader

Luxembourg the post-Brexit "jurisdiction of choice"

Country's RAIF structures, coupled with Britain's "wait and see" status, are luring more funds to Luxembourg

Q4 Barometer: Large-cap deals boost value in a shrinking market

Spike in megadeals boosted aggregate deal value in Q4, though volume was down 20% year-on-year

DACH GPs hunt for value following fundraising bonanza

With strong fundraising activity in the region, GPs must now find value in a challenging market

Deal in Focus: Wise backs Tapì's SBO

Italy-based bottle cap producer will adapt its expansion strategy to account for geopolitical developments in Central and North America

Belgium aiming to boost fintech investments

New Belgian-focused fintech initiative will develop close ties with London and bridge the gap between the UK and Europe

Modern TMT managers challenge traditional skin-in-the-game incentives

Private equity investors face a challenge to hold onto business managers for a 3-5 year holding period

Deal in Focus: Cobalt makes 3.5x on TCS sale to Meeschaert

Vendor extended its holding period with LPs' blessing in order to fully implement its buy-and-build growth strategy

Building bridges between France and Africa

New BPI France and AfricInvest fund could incentivise French funds to increase investments on the African continent

Deal in Focus: Hannover Finanz backs PWK's MBO

An in-depth look at the GP’s acquisition of the German auto parts producer market

Italy aims to close the tech-transfer investment gap with Europe

As part of the Juncker Plan, EIF and CDP launched a €200m fund-of-funds to help finance Italy’s tech transfer

In Profile: Duke Street restructures Fund VI

Restructure and cornerstone fund paves the way for a new hybrid model

Tech and venture lead the way in May's post-Brexit vision

UK government hopes venture and technology growth will ameliorate financial services exit

Veterinary sector proves pedigree with litter of PE deals

Demographic trends underpin PE interest in European veterinary care and adjacent sectors

Deal in Focus: Advent, Bain buy German payment service Concardis

After Worldpay, Nets and ICBI, the Concardis deal marks the fourth acquisition in Europe for the private equity duo

Bridgepoint sells Nordic Cinema Group in SEK 8.25bn trade sale

GP exits alongside Swedish media group Bonnier after hold of less than two years

Hope hangs on VC deals as Ukrainian buyouts disappear

Positive trends in growth deals driven by interest in the software and IT sectors