Top story

Deal in Focus: Chequers exits Provalliance group

Hair salon business Provalliance generates €1.2bn in revenues serving 35 million customers per year

Fund in Focus: Citizen closes second fund on €43m

Final close comes after two years on the road for the GP's second venture vehicle

Packaging sector poised to secure status as PE pillar stone

Resilient nature of the sector and plentiful supply of consolidation opportunities could lead to a resurgence in activity

KWM's PE practice founder Jonathan Blake joins O'Melveny

Departure marks the latest in a series of partners to leave the embattled law firm

PE's balancing act: LP appetite remains strong despite challenges

Part two of our Q&A session with PE experts from across the market with discussion centring on fundraising, co-investment and Brexit

From turmoil come treasures: Mapping out PE's road ahead

A panel of private equity experts from across the market discuss developments from 2016 and the outlook for the year ahead

In Profile: Rutland Partners

GP most famous for rescuing Pizza Hut talks to unquote" and explains the importance of co-investment in its Maplin deal

Graphite reaps 3.7x on £215m sale of MTS to Sumitomo

Trade sale is the latest in a series of high profile PE divestments of UK assets to international buyers

The must-read stories of 2016

unquote" looks back on a tumultuous 2016, rife with momentous events but also clear opportunities for the industry to shine

unquote" data snapshot: largest buyout fundraises of 2016

Though the number of €1bn+ funds to hold final closes fell in 2016, a number of large-cap players remained active on the fundraising front

Deal in Focus: Astorg sells Kerneos to Imerys for €880m

Sale of the specialised chemicals company follows a three-year holding period in which the group invested in new ventures and made bolt-ons

In Profile: Lyceum Capital

GP has deployed 70% of its third fund and will start raising its fourth in 2017

unquote" data snapshot: the five biggest buyouts of 2016

The year’s two largest deals, somewhat unusually, took place in Italy and Poland

In Profile: HIG Europe

GP has been particularly active in 2016, completing five exits and two buyouts, with two further deals in the pipeline

Benelux dealflow all but freezes over in H2

Despite a solid H1, deal volume plummets in second half of 2016, though average ticket size rises

GP Profile: Inflexion Private Equity

As part of our In Profile series, unquote" takes a look at the GP's busy 2016 and rapid-fire fundraises

Southern European activity fails to replicate 2015 surge

Italian private equity continues to dominate southern Europe, though the Iberian peninsula continues its recovery

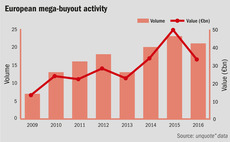

Mega-deals cap good year in CEE

Region registers two €500m-plus deals in the final quarter of a strong year for private equity

DACH buyouts on the rise throughout 2016

Despite low dealflow, the region saw an increase in buyouts during the course of the year, as aggregate value remained resolute

UK debt market rebounds in response to lower yields

Debt volumes were up 9% in Q3 2016 as lower yields prompt wave of recaps and refinancings

Investec unearths PE succession contradictions

Perceived importance placed on succession planning by GPs is not always mirrored by firms' approaches to transitioning control

French PE sees higher valuations in 2016 as dealflow drops

Increased competition and readily available debt lead to multiples creeping up in the country

In Profile: ECI Partners

As part of our In Profile series, unquote" speaks to managing partner David Ewing about deploying the GP's 10th fund and debt-market developments

UK dealflow suffers sharp drop post-Brexit

Aggregate value across the market is down by more than half year-on-year between July and November