Top story

Deal in Focus: Bain and Cinven to take Stada private

Acquisition of German pharmaceutical company would be the largest buyout ever recorded in the country

Nordic buyout market off to slow start in 2017

Buyout volume in Q1 was slowest start to a year since 2013, while Q1 exit figures were at their lowest first-quarter level since 2011

Insurtech puts a premium on technology

PE and VC players turn their attention to the insurance space as fintech's next scalable disruption opportunity

Luxembourg becoming a hub for German funds

GPs are increasingly chosing to domicile funds outside of Germany as fundraising in the country gathers pace

Contrasting fundraising fortunes in French mid-market

Numerous closes in Q1 and more on the horizon will give a clearer view of the French fundraising landscape

Could China boost Italy's private equity activity?

Italy's hunt for Chinese capital could clash with Beijing's new investments policy

Deal in Focus: Ardian to take majority stake in Prosol

French hypermarket group reportedly valued in the region of €1bn, with existing investors remaining as minority backers following completion

Dino Polska IPO could revive public exit route for PE in CEE

Public market exit route has been in decline for central and eastern European private equity since its 2013 post-crisis peak

Credit funds eye opportunity in ECB limits on bank leverage

Draft guidelines from the European Central Bank propose a suggested ceiling of 6x EBITDA for leveraged buyouts

Dutch elections: A rosier picture for PE

Netherlands' election outcome spells good news for the industry, as PE-sceptic Labour loses seats

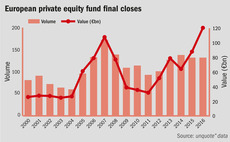

European fundraising surpasses pre-crisis high

Funds investing in Europe raised €120bn in 2016, up 37% on the year before

GP Profile: Bain Capital

GP is currently investing from its $3.5bn fourth European buyout vehicle, which closed in 2014

Denmark suffers from lack of newcomer buyout firms

Country lags behind its Nordic counterparts in terms of new private equity players, despite a growing number of buyouts

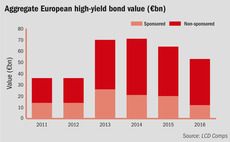

High-yield issuance for PE buyouts hits six-year low

Loan market flexibility and pricing steal the limelight as high-yield market for buyouts raises lowest total since 2010

EQT to onshore all funds in Luxembourg, ditch UK post-Brexit

Brexit-driven uncertainty has ruled out the UK as a future jurisdiction for EQT funds, COO Casper Callerström tells unquote"

UK private equity's northern awakening

North of England is well positioned for substantial PE-backed growth in the coming years, accelerated by infrastructure investment

Private equity must wise up to cybersecurity

Private equity practitioners must act to avoid becoming the newest soft target for cybersecurity attacks, says Nazo Moosa from Riyad Taqnia Fund

Placement agents: Adapt to succeed

Evolving fundraising landscape means placement agents are having to reinvent themselves to future-proof their offerings

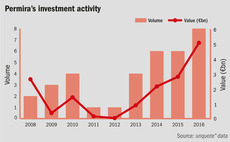

GP Profile: Permira

Global large-cap investor closed its latest buyout fund on €7.5bn in February 2016, making three investments from it to date

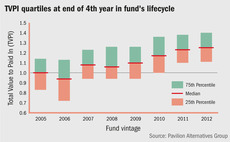

Strong returns: Are managers or the market due credit?

Beneficial exit market of recent years may not endure the next PE cycle, raising questions as to how strongly LPs should reinvest in the asset class

GPs and non-execs: Partners through thick and thin

Recent reports have questioned the logic behind appointing NEDs to portfolio companies, though there is little sign of GPs changing their approach

Portugal boosts southern Europe's 2016 resurgence

Recent uptick in the country's buyout activity mirrors similar investor appetite seen five years earlier in Spain

French Tech initiative launches visa programme

France's new "tech visa" is designed to attract talent and investment into the country's startup space

How many more generalists can the Nordic PE market bear?

Competition for capital and assets in the Nordic region has skyrocketed to the point of possible oversaturation