Top story

The call of Africa: Stability returns amid strong macro

Despite political instability, Africa's young demographic and increased urbanisation mean the continet continues to offer high-growth opportunities

Comment: Measuring the immeasurable

Environmental, social and governance considerations in developing markets can help identify the strongest assets and boost fundraising

In Profile: Sovereign Capital

unquote" takes a look at the buy-and-build specialist's recent deals and its pre-market approach to deal origination

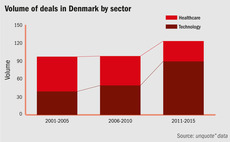

Denmark increases share of Nordic PE deals

Southernmost Scandinavian country was the busiest country by deal volume in 2015

Brexit opens opportunities for Italian private equity

Following the Brexit vote, Italy senses an opening to forge a new role in the continent

In Profile: Phoenix Equity Partners

unquote" takes a look at the firm's strategy and recent exits as it navigates the fundraising trail

British private equity braces for post-Brexit uncertainty

While the effects on medium-to-long term dealflow are uncertain, the future of fundraising will be dependent on access to the single market

Tech drives Danish PE as healthcare loses ground

Denmark's technology sector has fueled the rise of the local private equity industry

Deal in Focus: NVM injects £2m into Lending Works

Peer-to-peer lending platform is to undertake a recruitment drive

Benelux: alternative lenders to the rescue

With Benelux deals on the wane, could more flexible financing methods unclog the region's private equity market?

CEE exit pace rebounds on strong macro

So far in 2016, unquote” data has recorded the highest volume of exits in H1 since 2013

German PE develops a growing appetite for startups

VCs including Earlybird's Brandis discuss the growing trend of private equity houses taking part in growth capital deals within the country

French PE must exploit "momentum", says new Afic chair

Olivier Millet outlines his key priorities in an interview with unquote" following his appointment

Deal in Focus: Kartesia in Desmet Ballestra debt-for-equity swap

unquote" looks back on alternative lender Kartesia's progressive takeover of the Belgian-Italian group

Deal in Focus: Quilvest exits Acrotec in uncertain Swiss watch market

An in-depth look at the recent sale of watch component maker Acrotec by Quilvest to Castik

New rules for Italian debt create opening for alternatives

Italy opens up its credit market to European alternative investment funds

In Profile: LDC

unquote" takes a closer look at LDC in light of the captive's explosive deal activity in recent months

Q&A: Private Equity Partners' Fabio Sattin

Fabio Sattin says Italy is opening up to alternative lenders and hybrid instruments

Abundant dry powder fires secondaries prices sky high

This second installment of our secondaries focus takes an in-depth look at pricing trends

Prime-time for secondaries

The secondaries segment has clearly been popular with LPs, but can it cope with mounting levels of dry powder?

CEE private equity confidence rebounds

Despite low dealflow in 2015, PE confidence in central, eastern and south-eastern Europe is rebounding to more normalised levels

Brexit: The only certainty is uncertainty

While the long-term economic pros and cons of severing EU ties are up for debate, short-term uncertainty would be troubling for business leaders

Reputational risk continues to haunt Swedish private equity

Increasing attention from the media, regulator and politicians means Swedish firms must invest responsibly and highlight their growth credentials

Co-investing with corporate venture is not without its pitfalls

Venture capital firms can benefit from cooperation with CVCs but must be wary of those that value strategy over returns