Top story

Deal in Focus: Siparex acquires Ligier from 21 Partners

Under the vendor's tenure, the microcar business embraced electrification and driverless technology, enabling expansion across Europe and farther afield

In Profile: Livingbridge

Wol Kolade talks to Denise Ko Genovese about plans to open an office in the US on the back of success in Australia and the scarcity of online expertise

Beyond capital: winning over Germany's Mittelstand vendors

Increased competition for family-owned assets means investors must be flexible and willing to veer away from textbook strategies

Polish buyouts keep CEE afloat

Poland has established itself as the largest buyout space in CEE

In Profile: Dunedin

With its latest fund surpassing target, unquote" catches up on the firm's strategy and recent CitySprint exit

Benelux's PE legislation: Clearing up or losing ground?

Changes to Luxembourg's company law should modernise fund structuring, while in the Netherlands minor tweaks will change the way co-investors are regarded

Could Brexit mean lighter regulation for private equity?

Taylor Wessing: UK will eventually decide to join the queue of other passport applicants, alongside the US, the Cayman Islands, Bermuda

Byron disaster puts PE on the grill

While many observers criticised the burger chain's role in deporting employees, the controversy raised questions of its private equity owners

French dealflow holds steady in H1 despite domestic turmoil

Private equity activity has remained strong in a country experiencing turmoil brought about by terror attacks, labour law reforms and protests

Nordic buyout values soar amid high-liquidity environment

Average Nordic buyout values are growing, with the market expecting higher entry multiples and more leverage

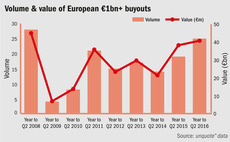

Southern Europe leads renaissance of billion-euro club

Dealflow in the тЌ1bn+ buyout segment reached an eight-year high across Europe in the 12 months to Q2 2016

Post-communist succession driving Czech dealflow

First generation of entrepreneurs that followed the fall of the Soviet Union look for new owners

Spanish fundraising offers hope amid lacklustre dealflow

Spain’s private equity activity suffered from political uncertainty in H1 but nevertheless managed to attract its fair share of international dry powder

Deal in Focus: Naxicap acquires Texa from Apax

Following a successful buy-and-build strategy, Apax decided to divest the business rather than commit to a further three years of ownership

UK debt volumes drop in Q2 as Brexit puts brakes on issuance

Brexit prospects impacted issuance in the UK in the second quarter, but strong buyout volumes across Europe helped keep loan volumes afloat

Q2 Barometer: European buyout activity rebounds

European deal volume reached its highest total in six quarters, while aggregate value increased by 80% compared to Q1 levels

Deal in Focus: Polaris's exit of CWS fails to meet par for GP

The Danish wind turbine services business was always destined for a strategic buyer, but failed to prove a hit for Polaris

Deal in focus: IK sells Vemedia to Charterhouse Capital

Vendor's international buy-and-build strategy helped transform the Belgian pharmaceutical company into a pan-European force

Are PE houses too slow on the digital uptake?

While the industry is reluctantly modernising its digital approach, software improvements and transparency requirements are accelerating the transformation

The call of Africa: Exit focus

Comparatively longer holding periods and sales to PE buyers or strategic investors characterise the continent's current exit market

The call of Africa: Risk mitigation

Certain risks are common among most African markets, but private equity firms have identified stategies to safeguard against these

International buyers swoop for low-hanging Brexit fruit

Devaluation of the pound has made UK assets attractive to non-sterling investors, though the opportunity may be short lived

In Profile: Palatine Private Equity

Following the final close of its third fund in 2015, unquote" analyses the GP's regional approach, generalist remit and the importance it places on ESG

The call of Africa: Risks and opportunities

Perception issues mean investors do not always fully appreciate the openings available across Africa, yet the continent's mid-market is flourishing