Top story

PE & VC key for French economy, says minister Macron

Speaking at the Afic Annual Conference 2016 in Paris at the end of May, Emmanuel Macron had kind words for the industry

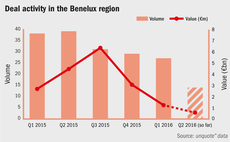

Usual suspects working hard in sedate Benelux market

Trend of declining dealflow in the region shows little signs of change, though buyout multiples return towards lower long-term averages

Generational turnover makes PE in Italy more pressing than ever

Succession challenges and internationalisation opportunities are drastically altering the Italian dealmaking environment

British investors hold fire as EU vote looms

Dealflow and aggregate value drops to 2009 levels as uncertainty puts private equity firms' plans for UK investments on hold

In Profile: IK Investment Partners

Having recently returned to the small-cap space, unquote" takes an in-depth look at the firm's overall strategy, fundraising, deals and team

VC financial engineering fuelling tech bubble?

Downside protection in later VC-backed funding rounds is increasingly presented as justification for growing valuations

August holds first close for fourth fund

August Equity has reached a first close for its newly launched fourth fund, unquote" has learned

Deal in Focus: Montagu acquires August's FSP

Tertiary buyout will pave the way for further consolidation of the funeral services market, which has proven highly popular among PE players

Comment: The impact of lifting Iranian sanctions on private equity

The lifting of international sanctions has opened Iranian borders to European investors, but the gates are still not fully open

Q1 Barometer: Slow start across Europe despite French uptick

The European buyout segment witnessed a slow Q1 volume-wise, with the number of deals recorded being the lowest total since Q1 2014

Deal in Focus: Norvestor defies oil & gas downturn with HydraWell

Oil well integrity company, which will expand internationally, has enjoyed growth against a backdrop of oil price volatility and investor concerns

Deal in Focus: Telepizza listing leads southern Europe IPO wave

An in-depth look at Telepizza’s listing on the Spanish stock exchange

Navigating the complex world of co-investment

unquote" gleans insight from Capital Dynamics' David Smith on the intricacies of co-investment

PE and the 4th Industrial Revolution: Blurring the lines

Part four: with an increasing number of VC-backed tech unicorns, private equity players are changing the face of later-stage funding rounds

PE and the 4th Industrial Revolution: The new deal

Part three: is private equity waking up to the realities of investing in companies at the forefront of the Fourth Industrial Revolution?

Deal-by-deal emerges as contender to fund-based investing

LP appetite for co-investment has led to the increasing popularity of the deal-by-deal approach; we assess two GPs that have employed both strategies

PE and the 4th Industrial Revolution: Seizing the initiative

Part two: private equity players must embrace the Fourth Industrial Revolution and identify when challenges can be turned into opportunities

PE and the 4th Industrial Revolution: Proceed with caution

Part one: technological advances are at the forefront of the so-called Fourth Industrial Revolution, but what are the implications for private equity?

Disruption case study: Apperio

Real-time legal fees tracking platform Apperio is trying to disintermediate PE legal services market

Q&A: Rutland Partners' David Wardrop

Partner David Wardrop discusses how the firmтs past experience of special-situations investing benefits its new portfolio companies

Comment: Change creates the future

Grant Thornton's Charles Toosey discusses how to attract graduates and investment into a reawakening industrials sector

Reforms fail to redress Spain's lack of domestic LPs

As international funds increase their exposure to Spanish private equity, domestic LPs remain in frustratingly short supply

How French private equity creates value

French GPs rely overwhelmingly on organic EBITDA growth to drive value creation, according to a new, in-depth study conducted by trade body Afic and EY

Another bumper year for VCT fundraising despite rule changes

VCT funds have pulled in record amounts this year, but how easily will deployment be given recent rule changes?