Top story

Unquote Private Equity Podcast: European tour

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team examines the key takeaways from IPEM and SuperReturn

VC activity picks up steam in Spain

Venture capital activity maintained momentum in 2018, largely fueled by international players in later-stage rounds

Nordic GPs set their sights on the DACH region

Nordic buyout houses are increasing their presence in the region, both in terms of deal activity and boots on the ground

French PE readies for wide-ranging economic reforms

PACTE plan currently working its way through parliament could boost ESG and take-privates, in addition to increasing public funding for venture

UK's financial sector buyout slump persists

Deal volume in the sector fell for the fifth consecutive year, with aggregate value falling for the fourth consecutive year

Nordic giants drive region's aggregate value jump

Aggregate value of buyouts in the Nordic countries jumped to тЌ25.7bn in 2018, a 66% increase on 2017

Unquote Private Equity Podcast: Crypto craze

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team decodes the intricacies of securitised token offerings

Co-piloted investments prepared for take off

PE is displaying a growing willingness to invest in minority deals, with some GPs raising dedicated vehicles for the strategy

Large-cap deals turbo-boost Benelux buyout market

Deals valued at more than €500m reached a post-crisis peak last year, even setting aside Carlyle's €10bn AkzoNobel carve-out

Contrasting fortunes: debt and venture secondaries

Private debt secondaries have the wind firmly in their sails, while the longer-established venture secondaries space is still an acquired taste

Strong LP appetite and creative credit to fuel DACH growth

Despite stiff competition for assets, PE firms in the DACH region hit record deal volume in 2018 and expect further growth in 2019

GP Profile: Astorg

Managing partner Thierry Timsit discusses investment strategy, competition, ESG and political instability

Strong Italian dealflow boosts southern European activity

Italy reached an all-time peak in terms of buyout dealflow and aggregate value in 2018, boosting the region's figures as a whole

Unquote Private Equity Podcast: Dual speed ahead

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team navigates the bifurcation in private equity fundraising

US investors eye European first-time funds

Maiden fundraises are maintaining momentum, with US institutional investors increasingly drawn to such vehicles

Q4 Barometer: European deal volume sets new annual record

Despite a slowdown in the final quarter of the year, private equity activity reached an all-time high over the course of the year

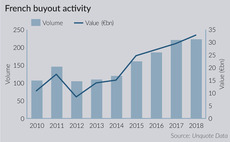

French buyout value climbs to post-crisis peak

Total deal value comfortably surpasses 2017's figure in a market driven by fierce competition, high prices and easy access to debt

Unquote Private Equity Podcast: Minority report

Listen to the latest episode of the Unquote Private Equity Podcast, in which our Precogs envision PE's future of non-controlling stakes

ADM raises $450m for Cibus Fund

Vehicle was launched at the end of 2016 and held a first close in May 2017 on $100m

Unquote Private Equity Podcast: High-water marks and PE larks

Listen to the latest episode of the Unquote Private Equity Podcast, wherein the team discusses the 2019 Annual Buyout Review, Nordic PE's record year and more

Draper Esprit buys stakes in Earlybird funds

Draper Esprit will fund the acquisitions by issuing up to ТЃ100m in new shares on the AIM segment of the London stock exchange

Benelux venture fundraising outpaces buyout counterpart

Last year’s €887m committed to venture funds is the second highest ever seen in the region, after 2016’s record of €1.03bn

New shop on the healthcare block: Gyrus Capital

New investment adviser will target value-based, special situations and transformational investments in the healthcare sector

Baltic buyouts boom as CEE slumps

Dealflow in the wider CEE region slumped in the first three quarters of 2018, but Baltic states enjoyed an uptick in activity