Top story

LP Profile: Industriens Pension

LP's head of private investments, Ostergaard, speaks to Unquote about allocation strategy, co-investment and first-time funds

Synova reaps 5.6x from Stackhouse Poland sale to Gallagher

Sale of specialist insurance broker comes four years after the GP's initial investment

Bowmark holds final close for sixth fund on £600m target

Value of commitments is 60% higher than the vehicle's 2013-vintage predecessor

Q&A: Sebastien Canderle

Unquote catches up with Sebastien Canderle to discuss his latest book and his views on private equity

PE and the banking sector: a challenging marriage

Fund managers are increasingly investing in the banking space, despite regulatory challenges and potential conflicts of interest

Brexit apprehension brings sharp drop in UK deal activity

Country suffers a larger drop-off in aggregate buyout value than any other European region in the first 11 months of 2018

French PE investment in aerospace soars to new heights

Asset class is fuelling growth in the industry, with aggregate value in France picking up pace in recent years

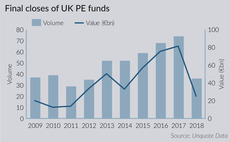

Brexit puts the brakes on UK fundraising

Country records its sharpest decline since the turn of the century in 2018, with anxiety around Brexit chief among investors' concerns

Q&A: Hermes GPE's Elias Korosis

Unquote speaks to the LP's head of growth investing about gaining access to the best deals and being a good partner to GPs

Mega-funds ignite Nordic nations

Region's PE fund managers raised the highest annual aggregate commitments on record in the first three quarters of the year alone

Q3 Barometer: European PE's strongest third quarter

European market had its most active third quarter on record in 2018 in terms of dealflow

Attracting tech talent top priority for Nordic GPs

Industry players at the Unquote Nordic Private Equity Forum discussed the region's track record and future challenges

Italy's battle with EU raises risks for private equity

Stand-off surrounding Italy's draft 2019 budget threatens to derail recent progress in the country's PE landscape

Q&A: Forbion Capital Partners' Sander Slootweg

Managing partner at the life-sciences-focused VC speaks to Unquote about fundraising, pursuing a 'build' strategy and the European market

GP Profile: Auctus Capital Partners

Unquote speaks to the firm's founding partner, Ingo Krocke, about Auctus's evolution and a continued focus on the lower-mid-market

French travel sector deals take off

Investments have rebounded in 2018, with the perception of geopolitical threats subsiding and shifts in consumer habits presenting opportunities

GP Profile: Tikehau Capital

Unquote speaks to UK head Cirenza about the asset manager's evolution and experience investing across the capital structure

Q&A: Inverleith's Paul Skipworth

Unquote speaks to managing partner Skipworth about fundraising process and deploying capital in the embattled UK consumer space

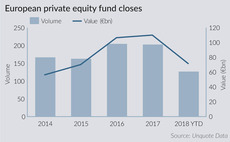

European fundraising cools down after bumper 2017

Number of fund closes by European PE firms and their aggregate commitments have slowed down during 2018, following two years of relentless activity

Dutch small-cap buyouts see values soar

First three quarters of 2018 saw combined value almost reach 2017's full-year total, which was in itself a five-year peak

UK sub-£100m buyout volume rebounds

Dealflow for transactions in the lower price range hit a post-crisis quarterly peak in Q3

LP Profile: 57 Stars

Unquote speaks to managing director Cowan about the firm's investment approach, co-investments and impact investing

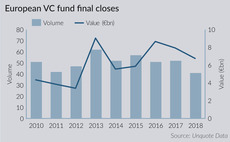

European VC fundraising continues strong showing

VC fundraising totals over 2016-2017 marked a healthy increase of nearly 50% on the amounts raised in the previous two-year period

Duke Street reaps 3.4x from £559m Wagamama trade sale

GP has sold the UK casual dining chain to listed trade buyer The Restaurant Group