Top story

Italian merchant bank begins direct PE investment

Italian turnaround

Mezzanine makes its comeback

Mezz bounces back

Nordic Capital: Clear strategy vital for success

Q&A: Nordic Capital

Equistone's de Blignières to raise €300m vehicle

Equistone senior partner Gonzague de Blignières is looking to raise €300m for Raise Capital, a new evergreen structure designed to provide growth capital to French SMEs.

LP interview: The secondaries saga

Founded in 1991, London-based Paul Capital has decades of experience in secondaries and fund-of-funds investments. unquote" talks to secondaries specialist and partner Elaine Small about the drivers behind the market's unprecedented growth.

BGF - two years on

BGF - two years on

Enterprise reaps 10x on Magellan

CEE investor Enterprise Investors makes 10x on share sale of Magellan, 10 years after backing the business. The returns come just a week after the GP made 9x on Kruk.

UK Watch: Q1 activity hits five-year low

UK private equity saw its worst quarter since 2009 despite widespread optimism in the market, according to the latest unquoteт UK Watch, in association with Corbett Keeling.

BVCA chief Florman resigns

BVCA chief Mark Florman has resigned after just over two years in the post.

CEE private equity: undervalued?

CEE: undervalued?

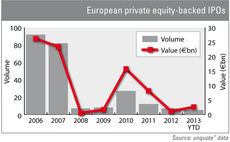

IPO activity dwarfs 2012 after first quarter

Private equity-backed IPOs are making a major comeback and could be set to reach their highest level since 2010, according to figures from unquoteт data.

Family offices set to increase PE allocations

Family offices

Moleskine's public market debut belies Advent's Milan closure

Syntegra's Moleskine, the golden boy of Italian private equity, has listed. But while the local GP revels in the benefits the domestic market affords, Advent International closes its Milan office. Amy King investigates

Eurozone shows greater appetite for Turkish delight

Turkish delight

German banking reform threat to private equity

The German government's draft proposals for banking reform, based on the Liikanen Report, are seen by many in the private equity industry as yet another threat from legislators, despite the unclear effect it may have on the asset class. Carmen Reichman...

Syntegra's Moleskine launches IPO

Syntegra Capital has launched the IPO of portfolio company Moleskine in a listing that could value the business at up to €530m.

unquote" Regional Mid-market Barometer

A rise in alternative lenders and a strong trade buyer presence helped drive the UKтs mid-market in 2012, according to the latest unquoteт Regional Mid-market Barometer, published in association with LDC.

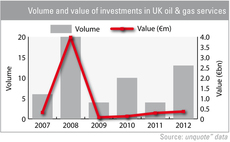

Private equity to benefit from oil & gas boom

The high price of oil could provide a boom to many operating in the oil & gas sector in the UK, and private equity players are looking to take advantage of the opportunities it offers.

IPOs "not best option" for private equity

While trade sales and secondary buyouts have been the most favoured exit route for private equity players, 2013 has seen renewed enthusiasm surrounding the public markets. Amy King reports from an ICAEW seminar on the IPO market

Abris closes latest CEE fund on €450m

Abris has exceeded expectations to reach hard-cap for its Abris Capital Fund II – despite no exits since the GP was founded in 2007.

Portugal's export credentials lure GPs back

Portugal's export edge