Top story

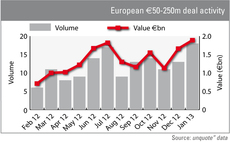

Lower mid-market buyouts hit €2bn record in January

France and the UK led Europe in January in the lower mid-market, which saw 18 such transactions across Europe worth a combined €1.9bn - the largest monthly value witnessed for a year. Greg Gille reports

DN Capital, MCI lead €15m round for windeln.de

DN Capital and MCI have invested in the latest and largest round for windeln.de.

CVC places Evonik shares as IPO markets wake up

CVC is the latest GP taking a more flexible approach to exiting its businesses, selling a share in chemicals business Evonik to institutional investors in preparation for an IPO.

Austrian private equity market gathers momentum

Austria’s private equity scene could be on the verge of a mini-boom as January’s deal activity has already outperformed last year’s first quarter.

Private equity's biggest scandals

Public image

Capital cities attract most private equity investments

Europe’s capital cities attract the lion's share of private equity investment, though other regions in Europe have been shown to be very active, according to new research from unquote” data.

SVG banishes the ghosts of the past

Just a year ago, things were looking very bleak for fund-of-funds manager SVG, but yesterday’s announcement of a new partnership with Aberdeen Asset Management has given the firm new reasons to be optimistic about its future.

French retail fundraising down for fourth year in row

France's FCPI and FIP retail vehicles – used extensively by the country's venture and growth capital players – raised €646m last year, down 12% from 2011 figures.

BVCA calls for return of taper relief

The BVCA has called for the return of the controversial taper relief for capital gains tax (CGT) in some cases.

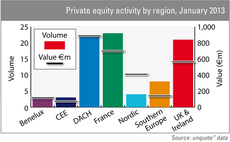

UK activity falls behind France and DACH

The UK & Ireland private equity market has been overtaken by the French and DACH regions in January according to figures from unquoteт data.

Finding a way to exit the boom year deals

Many of the headline-hitting buyouts of the boom era are still sitting in private equity portfolios. Charles Magnay, partner at Altius Associates, looks at how GPs have adapted to exit large companies in the post-Lehman world.

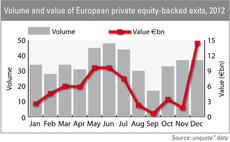

Exit market hits €15bn in December

Almost €15bn worth of capital was realised by private equity portfolio sales in December 2012, the highest amount in the past year, according to figures from unquote” data.

Vendors and banks amenable to strong 2013 in UK

Good signs for 2013

International interest picks up in Central & Eastern Europe

European private equity was abuzz with exits paving the way for fundraisings last year, and CEE was no exception. Kimberly Romaine reports

Italy: Diamond in the rough

Diamond in the rough

Fundraising booms in January

The beginning of 2013 has seen a swathe of fundraising announcements, with several funds reaching their target. Could this trend be a sign that investor appetite for private equity is returning?

2013: long on exits, short on new deals

The year ahead will be one of exits and pockets of liquidity in financing markets – but new deals and traditional funding may be weak.

UK Treasury delays AIFMD until 2014

UK firms have been given an extra year to comply with AIFMD, as the Treasury sets out implementation in a new consultation paper.

France's fresh start

Fresh start

A happy New Year for venture capital?

Happy New Year

UK Watch: Large deals boom in 2012

The final quarter of 2012 saw the highest large deal volume since early 2010, according to the latest unquoteт UK Watch, in association with Corbett Keeling.

PE and venture houses converging on growth

Buyout houses and venture capitalists are increasingly moving into the growth capital space due to pressure in their normal market segments, according to Taylor Wessing.

Q4 Barometer: European deal value up 82%

Q4 Barometer

Nordic private equity's 2012 highlights

Even the strong Nordic economies have struggled in 2012, as their key trading partners in the eurozone suffer under the weight of Greek and Spanish debt. Deal activity is down and Sweden's tax men are keen to take a cut of the private equity industry's...