Top story

Q&A with Aztec Group's Harrison: Outsourcing demystified

Aztec's Harrison speaks with unquoteт about modern fund administration and how the role has adapted to a new market

BC-backed Springer Nature prepares IPO

Germany-based media company is targeting a capital increase of €700-800m via the flotation

Deal in Focus: IK buys Studienkreis from Aurelius

IK had considered previous opportunities in the education space, with the firm's partner Petersson saying the sector offers good opportunities for PE

UK autumn budget: industry reactions

VCT and EIS fund managers and trade bodies broadly welcome the autumn budget, as BBB receives an additional ТЃ2.5bn in funding

The lure of consumer-focused fintech

European fintech companies are attracting increasingly large investment rounds

GP commitments: are pension pots a viable option?

Pension pots can help private equity professionals get 'skin in the game', says Apollo Private Wealth managing partner Nauman Gondal

Deal in Focus: Ardian merges Spanish bakeries Berlys and Bellsolà

Ardian's investment in Berlys and Bellsolà forms part of a consolidation play in the European frozen food industry

Technology: Europe's magnetic north

Mid-market deals in northern Europe are at the forefront of tech deal activity, with enterprise software and payment tech notable areas of attraction

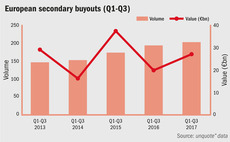

European SBOs reach record levels in first three quarters

Europe sees 202 secondary buyout deals between January and September, surpassing the peak of 200 seen in Q1-Q3 2007

UK tech dealflow resilient despite spectre of Brexit

UK investments accounted for 28% of European tech dealflow in the first three quarters of 2017, with a flurry of fintech deals already seen in Q4

Spain sails with fundraising tailwind

Increased appetite from LPs reflects a continually improving macroeconomic picture in Spain, despite signs that the recovery is slowing

Q3 Barometer: Market pauses for breath

European dealflow slows down compared with previous quarter but remains at historically elevated level

Entrepreneurial spirit helps French VC fundraising rebound

Venture fundraising reaches 2016 levels with two months left of the year, with early-stage and expansion dealflow also on the up

Average entry multiple climbs to 10.8x in Q2

Price inflation has led average European multiples to rise further in Q2, according to the latest unquote" and Clearwater Multiples Heatmap

Q&A: Rutland's Morrill and Wardrop on Millbrook and Pizza Hut

Special situations investor's partner and managing partner discuss the strategies behind the two award-winning investments

Picking a DACH mid-cap master

With so many proponents of the mid-cap space in the region, how do LPs decide on their allocations?

Tech deals return to the CEE region

Tech activity in CEE remains sluggish, though aggregate values are on the increase

Just rewards: Crowdfunding for German VC-backed startups

Rewards-based crowdfunding is not only more popular among VC investors, it is beneficial to startups too

Deal in focus: Springwater sells Delion four years after carve-out

Following a challenging investment in the comms industry, the company has been sold back to management

More alpha, less male: The gender diversity conundrum

Higher echelons of PE remain bereft of female talent, though signs of progress are appearing

SPACs offer flotation alternative for Italian GPs

Special purpose acquisition companies are gaining traction in Italy, offering an alternative exit route for GPs

Italian borrowers open up to private debt

Alternative lending is gaining momentum in Italy, with the leveraged finance market more lender-friendly than in neighbouring mature markets

Turkish IPO activity on the rise

Recent flotations could be a sign of what's to come, after the country relaxed its IPO rules

Benelux open for business as trade sales recover

Nine months into 2017, the number of exits to trade buyers exceeds 2016's levels, reflecting healthy European corporate M&A activity