Top story

Abraaj suspends private equity funds as founder steps down

CEO and founder Arif Naqvi passed the fund management reins to two co-chief executives

Italian private debt issuance jumps 35% in 2017

Southern Europe's two biggest markets differ greatly in their uptake of private debt, with Spanish players facing strong competition from banks

Private debt funds expand market share in Germany

Growing use of use of first-out, second-out unitranche leads to private debt funds more than doubling their share of German mid-market deals

European PE in 2017: Scaling new heights

Buyout activity and fundraising reached a new peak in 2017, with mega-buyouts and small-cap deals fueling dealflow and French funds popular among LPs

Q4 Barometer: Deal volume and aggregate value slide

Despite a boom in both dealflow and aggregate value across 2017 as a whole, the final quarter of the year saw a slowdown in activity

CEE mid-market players welcome renewed attention from larger GPs

Focusing on the mid-market pays off, as renewed interest from international sponsors affords interesting SBO opportunities

Less specialisation in southern Europe as generalists flourish

Trend of fund specialisation has been observed in European PE but LPs are still supporting less differentiated strategies in Southern Europe

DACH auto-parts deals motor on as sector transforms

Private equity players remain keen on auto-parts, as the sub-sector responds to rapid changes brought about by the electrical vehicle market

European PE in 2018: beware the bullet

unquoteт brings together a group of leading practitioners to analyse industry developments during 2017 and discuss emerging trends heading into 2018

European PE in 2017: fundraising tailwinds and growing leverage

Industry professionals look back on a resilient year for private equity during a period of turbulent geopolitics

Fundraising record rounds off active year for Nordic region

Region saw strong fundraising and high deal volume off the back of low interest rates in 2017

Tech gains traction in French private equity

Expansion deals and small-cap buyouts fuelled a strong 2017, with tech proving increasingly popular among buyout houses

Unquote's 2017 digest

unquote" looks back on an impressive 2017, which saw increases in the volume and aggregate value of buyouts and a buoyant fundraising environment

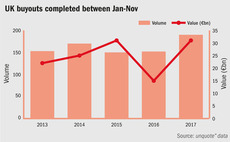

UK buyout activity reaches post-crisis peak in 2017

Small-cap and lower-mid-market invested strongly during the course of the year, while fundraising activity continued apace

Benelux funds specialise to compete with strategic buyers

Record level of commitments were secured by Benelux funds during 2017, with GPs increasingly turning to sector specialisation

Rise of the UK's private markets

Average values of British PE buyouts have soared over the last 20 years, as increasingly fewer businesses are trading on the London stock exchange

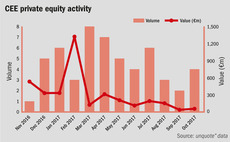

CEE closes out 2017 with strong investor confidence

Fundraising and deal activity both increased in the region during 2017

Shielding PE from political risk

Once a niche advisory sub-sector, political due diligence has now become an integral part of deal-making in Europe

DACH family businesses open up to private equity

Despite continuing low dealflow in the region, signs are emerging that family-owned businesses are warming to the idea of PE backing

Spanish private equity flourishes as Italian market cools

Southern Europe's leading PE markets responded drastically differently to the challenges of a turbulent 2017

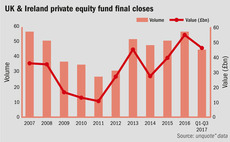

UK fundraising continues apace in 2017

Final closes in the first three quarters of the year show the UK is on track to surpass the post-crisis fundraising peak set in 2016

ICOs and venture capital: friends or foes?

With Asgard becoming the first European VC to hold a coin offering for its new fund, ICOs might present opportunities for institutional fund managers

Deal in Focus: BC-backed Sabre floats with £575m market cap

IPO of the insurance underwriter raised ТЃ206m to acquire shares owned by BC and other investors

Nordic Capital buys Alloheim from Carlyle

Reports put enterprise value at €1.1bn, 12.5x the company's €88m projected EBITDA