Top story

More balanced economy for Norway as tech attracts investors

As the country recovers from the 2014 oil price collapse, former engineers are emerging as entrepreneurs at VC- and GP-backed companies

Artificial intelligence offers smart opportunities for PE

Once the domain of early-stage VC investors, the AI segment is now attracting the attention of private equity buyers

German election: PE assesses likely coalitions

Coalition between CDU and FDP would be more supportive of private equity by nature

Minority investments brewing in the UK craft beer space

Negative connotations associated with the sale of microbreweries to conglomerates brings opportunities and challenges for PE backers

Essling to shake up funds-of-funds formula with new vehicle

Massena spinout Essling this month recruited the funds-of-funds team from Amundi and will launch its first vehicle shortly

Q&A: Baker Botts' Neil Foster on corporate venture

Law firm's partner speaks to unquote" about the growing prevalence of corporate VCs in Europe and its ongoing evolution

Deal in Focus: Carlyle sells Itconic to Equinix

Sale comes two and a half years after the GP acquired the business and is the first divestment for its third Europe-dedicated fund

H1 fundraising reaches second-highest level on record

Last three semesters represent a significant increase on the total sums raised for final closes, compared with historical levels

Nordic buyers increase dependency on family vendors

H1 saw the number of PE-backed deals sourced from entrepreneurs reaching a three-year high

UK venture awaits EIF replacement

New national investment fund will look to address shortfall in UK venture space and fill the void left by EIF's post-Brexit approach

DACH region opening up for PE activity in veterinary space

Local regulations surrounding consolidation in the sector have held back PE investment but EU court rulings could bring opportunities

International backers fuel record-breaking H1 in Spain

Country's dealflow has reached the highest level in value terms ever recorded

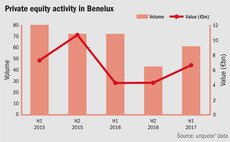

Benelux activity picks up in first half of 2017

Following a slow H2 in 2016, dealflow in the Benelux region is on the up with Belgium in particular seeing increasing activity

Aerospace investments taking off for PE

As evidenced by the recent VistaJet and Pattonair deals, PE is increasingly looking at the aviation and aerospace sectors for opportunities

Perfect fit: The evolving craft of fund financing

GPs are tailoring more complex and plentiful fund finance facilities to their advantage

Corporate caution creating carve-out opportunities for PE

Political instability may trigger a raft of corporate divestments, from which PE could profit

ECB leverage guidelines: casting too wide a net?

Debt advisory firm Marlborough Partners warns that the guidelines, as they stand, could impact deals with standard levels of term debt

Q2 Barometer: Aggregate PE deal value reaches 10-year peak

Deal numbers climbed for the second consecutive quarter, boosted by buyouts and growth capital deals

Apax/EPF merger highlights consolidation trend in French GP landscape

Apax's acquisition of EPF Partners is the latest in a number of consolidation plays within the French market

Germany's new foreign investment rules raise challenges for PE

Government's adoption of an amendment giving it increased rights of scrutiny could require increased due diligence for private equity houses

Deal in Focus: Ambienta carves out Restiani from Total Erg

An in-depth look at a difficult carve-out in the energy production market segment

Deal in Focus: Ekkio Capital exits Amatsigroup

Under the GP's seven-year tenure, the pharmaceuticals business bolted on numerous competitors and acquired new laboratories

French venture expected to flourish under Macron

VCs welcome the arrival of a president who is likely to encourage a more favourable investment landscape

Stapled secondaries moving upmarket

BC becomes the latest firm to benefit from a stapled secondaries deal, as some industry insiders anticipate a developing trend