United Kingdom

DFJ Esprit et al. back extended £6.9m Horizon Discovery series-C

A consortium of venture capital firms and private investors has injected a further ТЃ6.9m into Horizon Discovery as part of the final close of the company's extended series-C round.

Rutland picks up Equistone's AFI-Uplift

Equistone Partners Europe has offloaded AFI-Uplift to Rutland Partners in a deal that combines three companies for a total enterprise value of around ТЃ85m.

Serena Capital leads £10m round for WorldStores

Serena Capital and existing backers Balderton Capital and Advent Venture Partners have jointly invested ТЃ10m in a series-C funding round for UK-based online retailer WorldStores.

Sun European Partners in £23m Dreams debt pay-off

Sun European Partners is understood to have repaid ТЃ23m to creditors of Dreams, the UK-based bed retailer it acquired in a pre-pack deal in March.

Terra Firma granted EMI retrial

Terra Firma is to undergo a retrial over EMI as the private equity house continues to claim that Citigroup fraudulently forced it to overpay for the music group.

BC Partners hires ex-Blackstone MD

BC Partners is understood to have hired Matthew Tooth as a senior partner in its London office.

JC Flowers sells half of CCM to Encore

JC Flowers has sold a 50.1% stake in Cabot Credit Management (CCM) to Encore Capital Group for ТЃ128m, just two weeks after acquiring the UK-based consumer debt manager from AnaCap Financial Partners.

Spark and Accel invest $3.5m in Qriously

Spark Capital has led a $3.5m series-A funding round for London-based Qriously, alongside existing investor Accel Partners.

Enterprise Ventures appoints new mezzanine fund manager

Enterprise Ventures has hired Stewart McCombe to manage the firmтs ТЃ15m North West Fund for Mezzanine, which is part of the ТЃ185m North West fund.

UK consumer sector exits at record levels

The number of UK consumer goods assets divested by private equity firms is at its highest level in 10 years despite the continued desolation suffered by the consumer market.

Redpoint leads $7m round for Moogsoft

Redpoint Ventures has led a $7m series-A funding round for London-based service management software company Moogsoft.

BGF invests £6m in Petrotechnics

The Business Growth Fund (BGF) has backed Aberdeen-based Petrotechnics, a provider of software solutions for risk management in hazardous industries, with a ТЃ6m investment.

Beringea exits Fjord

Beringea has sold service design consultancy Fjord to management technology outsourcing and consulting service provider Accenture Interactive.

Graphite sells Dominion Gas to Praxair

Graphite Capital has sold Aberdeen-based oil field services company Dominion Gas to NYSE-listed Praxair.

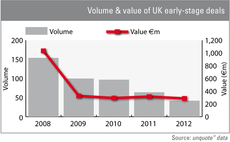

Value of UK early-stage investments holds steady

UK early-stage deal numbers are dropping off, but the total value invested has held steady over the last four years.

PineBridge's Calo joins Blackstone's Park Hill

Blackstone's placement agent division Park Hill Group has appointed Pablo Calo from PineBridge Investments.

Octopus leads £2.95m investment in Conversocial

Octopus has led a ТЃ2.95m investment round for social media management software company Conversocial.

Blue Water Energy reaches $861m hard-cap

Blue Water Energy's successful $861m fundraise makes it one of the largest post-crunch raises for a first-time team.

LDC backs MBO of Node4

LDC has backed the management buyout of UK-based IT and communications services provider Node4 Ltd.

Private equity tempted by Hotel Chocolat

Private equity houses are in talks with confectioner Hotel Chocolat regarding a possible purchase, which could see the company valued at around ТЃ100m.

British Gas leads £7m investment in 4energy

British Gas has led a ТЃ7m investment in 4energy alongside existing investors Environmental Technologies Fund (ETF), Carbon Trust Investments and Catapult Venture Managers.

The importance of being European

EU membership

Blackstone, Carlyle targeted by Stop G8 protests

Anti-capitalism protest group Stop G8 has publicised the London addresses of several private equity firms т including Blackstone, Carlyle and Lion Capital т ahead of the G8 Summit in June.

Ares hires former Blair adviser

Ares Management has appointed former Tony Blair adviser Charles Steel as managing director, heading up the fund's European private equity operations.