United Kingdom

Ferguson steps down as SVG shakes up board

Nicholas Ferguson will retire as chairman of SVG Capital at the end of this year, after 28 years with the firm.

Phoenix acquires Gall Thomson Environmental

Phoenix Equity Partners has acquired liquid product transfer equipment manufacturer Gall Thomson Environmental from trade player Lupus Capital.

Endless moves into asset-based lending

UK-based turnaround specialist Endless has launched Encina, a new business providing both asset-based lending (ABL) and equity investments.

Kinetic Partners expands into Luxembourg

Advisory firm Kinetic Partners has acquired Luxembourg-based fund advisory firm AB Fund Services.

UK & Ireland unquote" March 2012

With the UKтs VCT community getting ready for fundraising season, Prime Minister David Cameron joined a number of EU leaders calling on Brussels to boost economic growth by supporting investment.

Trade player considering rival bid for TPG target GlobeOp

Financial software and services company SS&C Technologies is set to outbid TPG Capital's offer for fund hedge fund specialist GlobeOp.

Greenpark Capital opens office in Hong Kong

Greenpark Capital has opened a new office in Hong Kong, to be headed by Chin Chin Teoh.

Gresham-backed TTG bolts on Red-M

Gresham Private Equity portfolio company Team Telecom Group (TTG) has acquired wireless technology company Red-M.

Key Capital appoints managing partner

Key Capital Partners (KCP) has appointed Owen Trotter, co-founder, as managing partner. His appointment is part of the firmтs strategic development plan.

Investec provides debt for 2M co-founder buyout

Investec has provided a debt facility for chairman and co-founder Mottie Kessler's buyout of 2M.

Matrix hits grand slam for deals, exits in 2011

As the downturn drags on, most GPs are laying low and hoarding cash. One small buyout house stood out for achieving four investments and four new exits in 2011 т and has just announced its independence. Kimberly Romaine reports

BGF: "We are not scraping the bottom of the barrel"

Business Growth Fund (BGF) chief executive Stephen Welton today addressed concerns about the fundтs approach to financing small UK businesses. Greg Gille reports

DC Advisory Partners appoints managing director

DC Advisory Partners has appointed Sergio Ronga as a third managing director to its debt advisory group.

AAC Capital UK sells Amtico to Mannington Mills

AAC Capital UK has sold Amtico Group, an international designer and manufacturer of high end flooring, to Mannington Mills, a US-based provider of branded flooring products.

Chamonix and Electra acquire Peverel from administrators

Chamonix Private Equity and Electra Partners have announced a ТЃ62m acquisition of property management services company Peverel Group from administrators Zolfo Cooper.

OEP buys Linpac Allibert

One Equity Partners (OEP) has wholly acquired Linpac Allibert, the returnable transport packaging business of Linpac Group.

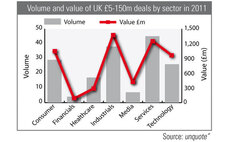

Business services keeps UK mid-market ticking

The UK's hugely important services sector remained key to the private equity market in the ТЃ5-150m segment. The 45 deals recorded in 2011 makes it easily the most important in volume terms, while its lower average deal size leaves it number two behind...

Apposite reaps 45% IRR on SureCalm exit

Specialist healthcare investor Apposite Capital has sold homecare services provider SureCalm Healthcare to medical technologies developer Amcare Ltd, reaping a 45% IRR.

Francesco Granata joins Warburg Pincus

Warburg Pincus has appointed Francesco Granata as an executive-in-residence focusing on the healthcare sector.

Blackstone refinances Center Parcs

Blackstone has refinanced holiday provider Center Parcs, injecting a further ТЃ100m of equity

CVC and ValueAct approach Misys

CVC Capital Partners and ValueAct Capital Master Fund, the largest shareholder in Misys, are said to be considering a joint cash offer for listed software business Misys.

YFM and EV reinvest in Peckforton Pharmaceuticals

YFM Equity Partners and Enterprise Ventures have joined the management in investing over ТЃ1m in portfolio company Peckforton Pharmaceuticals.

Crowe Clark expands its Thames Valley team

Crowe Clark Whitehill has appointed mergers and acquisitions (M&A) specialist Simon Jordan as a partner in its corporate finance team in the Thames Valley.

VCT MBOs must continue, says ICAEW

Proposed changes may strip VCTsт of their ability to back buyouts т but this would have dire consequences, according to ICAEWтs CF head. Kimberly Romaine reports.