Analysis

Debut managers to face daunting fundraising market in 2020

Debut managers out to market are unlikely to hold closes in 2020, and very few new teams are likely to launch funds

VC Profile: Speedinvest

Seed investor is opening a new office in Paris as part of the expansion of its pan-European platform

Turnaround funds eye European companies hit by Covid-19

Turnaround players have raised at least $5bn overall in Europe in recent years

PE examines portfolio liquidity options as coronavirus halts dealflow

Managing financial and liquidity risk is front of mind as managers fret over the potential impact of a severe downturn

UK Covid-19 liquidity support snubs leveraged and mid-market companies

CCFF initiative seems designed with traditional corporate issuers in mind instead of leveraged finance issuers

Secondaries: opportunistic buyers ready for fund stakes to hit market

With more sellers coming to market, prices are unlikely to stay at pre-Covid-19 heights, which could in turn encourage more opportunistic buyers

LP Profile: Kåpan Pensioner

Mikael Falck, head of alternatives, discusses the Swedish pension fund's appetite and exposure to the asset class

French PE steps up gender diversity goals and monitoring

French private equity association France Invest launched its gender-parity charter at IPEM

German VCs call for more Covid-19 startup support

Concerns centre around the profitability criteria, as well as local banks' lack of familiarity with startups' risk profile

Nordic buyout market has silver linings, despite low volume

Nordic region sees the lowest quarterly deal volume since Q4 2013, with just 17 buyouts in Q1 2020

Italy embarks on the "deep tech" revolution

"Deep tech" startups specialise in transformative technologies, such as nanotechnology, industrial biotech, and advanced materials

Viridor/KKR shows sponsor route to waste opportunities in Covid-19 market

Waste management, and particularly energy-from-waste, is fast becoming an area of heated dealflow

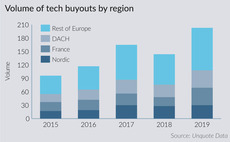

Technology buyouts stall in Nordic region

Technology buyouts have hovered around the 30-per-year mark for three years running now, suggesting a plateau has been reached

UK sees advisory boom amid PE market maturation

UK & Ireland sees an increase in the number of corporate finance firms participating in PE deals to more than 160

New perspectives: How secondaries are reshaping PE's risk profile

With LPs increasingly hungry for PE, the boom of the secondaries market can shift perceptions around the risks associated with the asset class

Acuris coronavirus impact analysis

Assessing the early impact of coronavirus on capital markets and sectors

Coronavirus outbreak leaves Italian PE industry in limbo

With Italy being the worst-affected European country, deals and fundraising are so far confined to a timeless limbo

Deal-doing slump threatens Benelux exit momentum

GPs divested or partially realised 90 assets last year, making 2019 the third busiest year on the exit front in the past decade

Secondaries sea change: Backing your winners

What was once the preserve of the underperformer is now shifting towards the prized asset

GP Profile: Crédit Mutuel Equity

Board member Christophe Tournier talks through the firm's minority focus, and the upcoming launch of an infra strategy

Podcast: In conversation with... Matthew Hardcastle, DealCloud

Hardcastle stops by to discuss his move from Inflexion to the world of tech, how GPs can unify internal processes to unlock value, and more

Private equity seeks solutions to uncertainty as coronavirus derails buyouts

Dealmakers are trying to keep the buyout show on the road as the coronavirus crisis overtakes the European market

Coronavirus outbreak could lead to fundraising logjam, PE players warn

Industry participants contacted by Unquote expect negative ramifications for fundraising as well as deal-making activity

VC Profile: Sofinnova Partners

Managing partner Graziano Seghezzi on the firm’s fundraises, its multi-asset strategy and the European life sciences VC space