Analysis

Podcast: In conversation with... Joe Moynihan, Jersey Finance

The inaugural episode in our new podcast series sees Joe Moynihan stop by to discuss how Jersey is positioned as a domicile for PE funds post-Brexit

How DACH players are adapting to ESG

ESG has become a key concern for GPs and LPs alike in the German market, but the approaches to it still differ

LP Profile: HQ Capital

Britta Lindhorst, managing director and head of European investments, talks about the investment climate and the organisation's plans for 2020

PE still hungry for retirement homes, but infra funds loom

Eight deals were completed in the retirement homes sector across Europe in 2019, above the annual average of five since 2014

VC Profile: CapitalT

Co-founder Janneke Niessen talks to Unquote about the firm's fundraise and its data-driven model to analyse startup teams

2020 Outlook: Southern Europe finishes 2010s on record high

Deal volume was the highest on record in 2019 with 174 buyouts, though aggregate value decreased to €25bn from €30bn

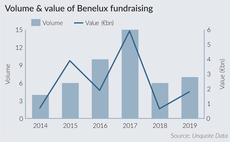

2020 Outlook: Benelux dealflow breaks records as fundraising recovers

While often out of the European private equity limelight on the deal-making side, the Benelux region quietly posted an excellent 2019

Unquote Private Equity Podcast: DACH fundraising special

The Unquote Private Equity Podcast hosts Paul Tilt and Harriet Matthews to discuss the findings of the latest DACH Fundraising Report

2020 Outlook: DACH buyout volume stalls amid macro uncertainty

Overall dealflow plateaued, with just one buyout more recorded in 2019 compared with 2018

IPEM TV 2020: direct investing still tricky, says Coller's Francois Aguerre

Aguerre explains why co-investments will likely remain a preferable option for large LPs

2020 Outlook: Tech deals boom while fundraising flourishes in France

Local GPs look forward to another busy year and hope to build on the record dealflow seen in 2019

Direct lenders eye secondaries market for first-gen funds

Several European direct lenders are speaking to secondaries advisers about running processes on older vintage funds

Unquote Private Equity Podcast: IPEM Highlights

The Unquote Private Equity Podcast recaps key takeaways from exclusive interviews with a number of speakers and delegates

IPEM TV 2020: Helen Steers discusses gender diversity in PE

Pantheon partner on the need to look at the retention of women in the industry as well as the pipeline of new entrants

2020 Outlook: Political change heralds UK buyout revival

Deal volume was down last year, but record-high value and a more settled political backdrop mean 2020 could be busy for the UK

IPEM TV 2020: Advent's Johanna Barr on navigating fund pitches

Managing director and global co-head of limited partner services shares key takeaways from her panel

IPEM TV 2020: Charterhouse Capital Partners' Gilles Collombin

Collombin discusses sourcing strategies and Charterhouseтs increased focus on co-investments

IPEM TV 2020: Jim Strang, Hamilton Lane talks private market trends

Strang talks performance of private equity versus public markets, capital overhang, and current challenges

IPEM TV 2020: ICG's Nicholas Brooks on prospects of recession

Recession remains unlikely, but low growth and the threat of potential trade wars are still of concern to investors

IPEM TV 2020: France Invest chair Dominique Gaillard on responsible investing

Gaillard urges the industry to do more to tackle climate change, diversity, and sharing value

IPEM TV 2020: Neuberger Berman's Patricia Miller Zollar on first-time funds

Miller Zollar shares the LP perspective on emerging managers and first-time funds

Fund focus: Lexington targets growing Asia secondaries market

GP's ninth fund closed on $14bn, above its $12bn target, and will target secondaries opportunities in Asia

Unquote Private Equity Podcast: the Review/Preview special

In this special bumper episode, the Unquote editorial team does a deep dive on key 2019 stats in each market

Corporate divestments fuel European buyouts

Carve-outs and spin-outs represented around 14% of all buyouts in 2019, up from 11.5% in 2018 and 10% in 2017, according to Unquote Data