Analysis

Model LPA – useful protection or unnecessary guide?

Fund formation specialists weigh in on ILPA's recently launched Model Limited Partnership Agreement

Unquote Private Equity Podcast: Craving carve-outs

Listen to the latest episode of the Unquote Private Equity Podcast, where the team discusses corporate carve-outs

Swiss and German venture peaks in Q3 2019

Aggregate value of venture deals in Germany soared to more than €2.73bn across 85 deals

Luxembourg's IFMs keep up with tech

Luxembourg and its myriad local administrators are working hard to adapt to the technology-driven shake-up of the fund admin space

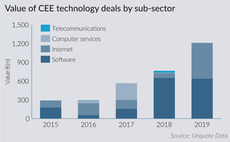

Software sector lures increasing amounts of capital in CEE

Interest in the software sector in CEE is on the up and was especially prominent in Q3

Minority investing gains traction in southern Europe

Abundance of dry powder and expected downturn have pushed GPs towards experimenting with more diversified ways of deploying capital

LP Profile: EQ Asset Management

Head of private equity Staffan Jåfs discusses the organisation's views on PE opportunities and its fundraising plans

Unquote Private Equity Podcast: Taking stock

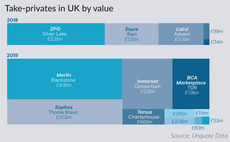

Listen to the latest episode of the Unquote Private Equity Podcast, dedicated to the resurgence of take-privates

Private wealth to increase allocation to private equity

High-net-worth individuals and family offices are hunting for yield, concerned about low interest rates and market volatility

UK-focused GPs getting creative with buyout sourcing

In 2019, 10 take-privates have been agreed in the UK and Ireland to date, up from five in 2018

French buyout fundraising soars in 2019

Mid-market and large-cap fundraising pipeline for 2020 also looks promising, but the market remains bifurcated

European biotech flourishes as US and Asian capital pours in

Attracted by a buoyant industry with a rich pipeline, numerous US and Asian players have entered the market

Dutch PE wrestling with gender diversity

Dutch GPs are lagging behind their British counterparts in terms of gender diversity, with women making up only 14% of Dutch PE professionals

Unquote Private Equity Podcast: Nothing ventured, nothing gained

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team tackles the venture capital space

GP Profile: DeA Capital

DeA's diversified offering across multiple asset classes reached €12bn in AUM in 2019

Mid-market stays loyal to English limited partnership

Luxembourg structures may have their proponents, but the Brexit drama does not seem to have dented the appeal of the English partnership

France: Private debt still thriving despite muted fundraising

Current fundraising pipeline and recent investment statistics suggest the French private debt space is still in rude health

Italian GPs embrace asset-class diversification

Local players have launched new strategies and vehicles dedicated to private debt, special situations, credit recovery and non-performing loans

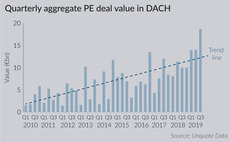

DACH activity skyrockets in Q3 despite looming recession

Aggregate value in DACH for Q3 reached its second highest level at €18.7bn

Team spirit: the enduring appeal of co-investment

This year, тЌ7.87bn was collected across seven co-investments funds, breaking Unquote Data records

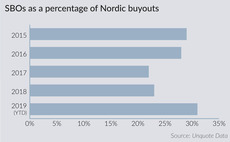

"Pass-the-parcel" deals surge in Nordic region as PE matures

At nearly a third of all buyouts, the proportion of SBOs is now higher in the Nordic region than it is across Europe as a whole

UK General Election: reactions from the PE community

Private equity players and advisers speak on the potential for the resolution of Brexit and the effect it may have on deal activity

CEE fund closes make headlines as dealflow slows

PE and VC activity has been rather sedate across the CEE region in October, with interim fund closes instead animating the market

LP Profile: Pensioenfonds PGB

Dick Tol discusses the pension fund’s investment plans, approach to responsible investing, and how its private equity strategy has taken off