Analysis

Direct lending growth continues unabated - report

According to Deloitte's latest Alternative Deal Tracker, €22.6bn alternative loan issuance was deployed across 178 deals in H1 2019

GP Profile: Stirling Square Capital Partners

Head of investor relations Monteiro de Barros discusses co-investing from day one and the benefits of staying small

Benelux biotech and pharma startups attracting larger rounds

Average tickets for early-stage investments have jumped from €13m in 2017, to €20m the year after and €36m this year

Unquote Private Equity Podcast: Co-op mode

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team talks all things co-investment

UK late-stage venture boom offsets early-stage lull

Second quarter saw an average value per deal of ТЃ30.7m, significantly higher than the 10-year average of ТЃ11.8m

Looking for the digital health tonic

Massive recent uptick in investment means 2019 is expected to reach an all-time high for digital health

International funds dive into southern Europe's education sector

Education institutions and online universities are flourishing in southern Europe, attracting international GPs

Treasure hunt: striking the right origination mix

Unquote explores technology-led advances and the evolution of the more traditional models

German banks lose position to debt funds

Private debt funds have supported the lion’s share of the German mid-market recently, with banks' risk aversion being cited as a key driver

Take-privates thrive amid growing pressure to invest

Public-to-private deals are back in fashion, with a record number of transactions

Unquote Private Equity Podcast: Calling in the specialists

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team discusses specialist and venture fundraising

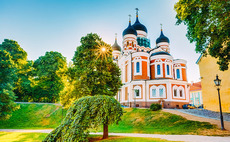

Resilient Romania attracting PE

PE investment across all brackets has picked up in Romania this year, and CEE stalwart Mid Europa has just opened an office in the country

Investors debate fund-size and specialisation at Nordic Forum

Panellists tackled fund diversification, portfolio company digitalisation and gender parity in management teams

LP Profile: Saranac Partners

Established in 2016, Saranac Partners is a multi-family office and financial advisory firm

French institutional LPs urged to nurture late venture

As president Macron pledges to unlock €5bn from institutional investors, Unquote looks at the current state of French late-stage venture

H1 Review: Deal volume steady in southern Europe; value drops

Region recorded 70 buyouts worth an aggregate value of €11.2bn in the first six months of the year

LP Profile: Polish Development Fund

The Polish Development Fund's private equity programme has kicked into gear this year, making three fund investments with more in the pipeline. Oscar Geen speaks to Annemarie Dalka about PFR's formation and investment strategy

H1 Review: Nordic pricing frothy as cross-border capital pours in

Nordic region retained its position as the most expensive place in Europe for private equity firms to buy companies in Q2 2019

Unquote Private Equity Podcast: Cloudy with a chance of slowdown

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team discusses H1 stats and looks ahead

H1 Review: Fundraising and local capital herald CEE buyout revival

Baltic market stands out, recording a higher than usual share of the wider region's dealflow

Secondaries volume up 25% in H1 – research

Setter Capital's latest research reveals a sizeable uptick in private debt deals, though private equity secondaries still dominate the market

H1 Review: Large-cap value drives Benelux buyout activity

H1's aggregate value of €11.1bn resulted in a 60% increase on H2 2018, and reveals large-cap activity remains strong in the region

GP-stake sales controversial among LPs

LPs are naturally reticent about their GPs selling stakes in themselves, as emphasis to boost profits from management fees strengthens

Buying and building the modern school

Investments in European private schools and colleges have proven enriching for PE over the past two decades