Analysis

Private equity in the age of digitalisation

Unquote and Taylor Wessing bring together leading tech-focused PE practitioners to discuss modern challenges and opportunities

UK consumer sector maintains appeal in H1

Activity in the space remained remarkably resolute in the face of mounting pressures on the high street

Benelux industrials booming and primed for internationalisation

Sector soars past consumer in terms of aggregate value of H1 buyouts, having historically attracted similar levels of PE backing

Healthcare under observation among European GPs

Digitalisation and vendors that are increasingly receptive to PE are providing opportunities in the sector

Nordics investors remain active but cautious

H1 buyouts drop in the Nordic region after a busy 2017 as SBOs and trade sales take off

International appetite for Spanish deals soars in H1

Country's dealflow and aggregate value both reached record or near-record levels in H1, with international GP's fueling mid- and large-cap activity

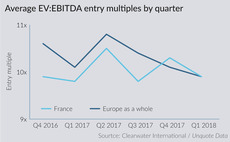

French mid-cap seeks new approaches as competition heats up

Buy-backs edge into the French mid-market, as H1 activity hits record highs and entry multiples swell

PE hot for insurance sector

Dealflow and aggregate value in the insurance sector has surpassed its post-crisis annual peak before the end of the third quarter of 2018

Fee structures: adventures in LP flexibility

As private equity continues to outperform other asset classes, some GPs are exploring new fee structures, with mixed results

LP Profile: Allianz Capital Partners

Co-head of PE Michael Lindauer speaks to Unquote about the firm's history and approach to investment

CEE dealflow drops in H1 as exits soar

Buyout activity in the first six months of 2018 was at the lowest H1 level seen since 2009

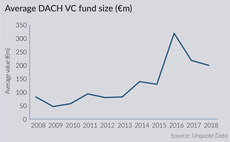

VC fundraising lifts off in DACH region

Six venture funds based in the DACH region have held final closes in 2018 for a combined €1.3bn

DACH leads lower-mid-market fundraising

An overcrowded lower-mid-market in the Nordic region and the UK, coupled with Brexit, has boosted DACH fundraising activity

GP Profile: Lakestar

Unquote speaks to founder Hommels about the VC's future ambitions and the European venture landscape

Q&A: Alto Partners' Raffaele de Courten

Unquote speaks to the firm's founding partner about fundraising, dealflow and debt facilities in the Italian market

LP Profile: Adams Street Partners

Unquote talks to Ross Morrison, partner on the primary investments team and responsible for mid- and large-cap fund investments

Reshaping the GP shareholding landscape

As the private equity market matures, shareholding structures of GPs are being reshaped, with a number of M&A transactions and minority stake sales

Tech buyouts bolster UK mid-market activity in H1

High multiples in the TMT space have played a part in driving activity in the UK mid-market over the first half of 2018

Entry multiples stay frothy in Nordic region

Valuations in the Nordic countries are notably driven by high-multiple deals in the TMT and business services sectors

Q&A: Rutland Partners' Nick Morrill

Managing partner Nick Morrill discusses how to thrive amid economic uncertainty and the current challenges of the UK's consumer sector

Private debt picks up steam in Italy

Debt fundraising activity has been vibrant in Italy in recent months with the launch of several vehicles

Allocate 2018: Risk-return for maiden managers and spin-outs

First-time vehicles have enjoyed historically good fundraising conditions over the last two years

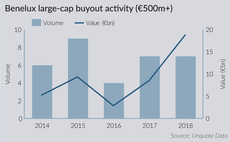

Benelux large-cap activity swells in H1

Aggregate value of deals valued at more than €500m is approaching pre-crisis levels, based on H1 2018 figures

Allocate 2018: ESG gains traction with European LPs

Numerous reports and studies have shown that LPs are increasingly concerned about their GPs' environmental, social and governance policies