Analysis

Women in VC: Revaia's Albizzati on founding a female-led firm and navigating valuations in 2023

Co-founder Alice Albizzati outlines the growth equity firm's priorities as it heads for the final close of its EUR 500m Fund II

IPEM 2023: GPs battle fundraising blues on the Côte d'Azur

Sponsors remain broadly optimistic despite fundraise bottlenecks and a growing number of LPs faced with tough choices on manager selection

German health minister's 'locust sponsors' comments spook live healthcare deals

New entrants scared by remarks on limiting profits; existing investors expected to rush to complete bolt-ons

Flight to quality, impact investing to drive allocations in 2023 – HarbourVest

Asset managerтs investment team discusses secondaries and co-investment dynamics amid a challenging fundraising market

Unquote Private Equity Podcast: The PE auction in times of exit scarcity

Rachel Lewis joins Harriet Matthews to discuss how auction process dynamics are changing against the current market backdrop

Series A rounds likely bright spots in VC investing in Q1 2023 – KPMG

Energy security, ESG deals to continue apace, with consumer-focused businesses seeing most strain

Going, going, not gone: PE auctions bid for relevance amid risk-off environment

With a debt financing drought and macro woes denting exits, GPs are adapting the traditional M&A auction in favour of more flexible bilateral negotiations to get deals across the line

Gatemore eyes larger stakes in listed SMEs as path to take-privates

With its first closed-end fund in the making, the activist investor will use larger stakes to drive value creation and direct small-cap targets towards PE sales

Women in VC: FundingBox.vc's Cymerman on new fund plans and the power of networking

Deep tech investor could look to raise EUR 50m-plus for its next vehicle, co-founder Iwona Cymerman tells Unquote

Unquote Private Equity Podcast: 2023 - New year, new market?

Unquote and Mergermarketтs private equity reporting team discuss the past 12 months and what lies ahead next year

Women in VC: Speedinvest's Nangia on supporting female and underrepresented founders

Austrian sponsor to invest 30% of capital in female, diverse founders; new fund-of-funds set to support emerging managers

Private Equity Trendspotter: Sponsors look for sure footing as market slowdown signals change in deals landscape

Aggregate buyout volume brings 2022 just 6% above pre-pandemic dealmaking, with a significant sentiment shift in H2 2022

Unquote Private Equity Podcast: Making an impact

Impact growth capital firm Lightrock's Pål Erik Sjåtil speaks to Unquote about impact investing and energy transition

GP Profile: Quilvest eyes lower mid-market niches as direct PE strategy grows

Direct private equity co-heads Thomas Vatier and Jay Takefman on the firm’s family roots and its approach to the current market

LP Profile: Stonehage Fleming anticipates largest ever PE programme in 2023

Multi-family office talks about doubling down on manager selectivity, opportunities in secondaries, and family offices' increasing interest in PE

GP Profile: EV Private Equity outlines plans for dedicated energy transition fund

Energy sector investor prepares to raise EUR 350m for Article 9 fund targeting renewable, clean tech businesses

Women in PE: Triton's Meier-Kirner on deploying in times of crisis and resisting herd mentality

Pan-European sponsor aims to back undervalued businesses and those with structural tailwinds using learnings from past crises

Sponsors ponder ESG questions as EU Taxonomy spurs gas, nuclear funding flow hopes

Framework gives green light to deals in the sector but LP accountability could stymie potential investments

VC Profile: Future Planet Capital steps up energy security investments alongside new fundraise, acquisitions

Impact investor remains focused on climate change but sees life sciences opportunities amid economic downturn

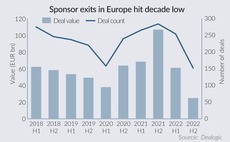

Final close: Sponsors fight through buyout fundraising drought

With EUR 100.5bn in commitments this year, European buyout fundraising is likely to be the lowest since 2018

GP Profile: Investcorp's GP stakes strategy sees strong dealflow ahead

Growing private assets market and changing LP perception will bolster GPтs mid-market strategy, Anthony Maniscalco tells Unquote

Emerging managers: "now is the time to back tomorrow's leaders" – Unigestion

Asset manager discussed outperformance of first-time funds and showcased new managers at a virtual event

GP Profile: Equistone banks on experience to ride through the next cycle

As the firm contemplates future fundraising, Unquote speaks to partner Tim Swales about the GPтs current outlook

Women in PE: Avallon's Pakulska on fundraising, exits and the role of sport in business

Women in Private Equity is a new series aiming to highlight both news and personal insights from key women in the PE sector internationally