Venture, tech keep UK market afloat in H1

While buyout and exit volume dropped dramatically in the first half of 2020 in the UK and Ireland, venture investment volume has remained resilient and the technology sector has become an even larger focus for the private equity industry. By Katharine Hidalgo

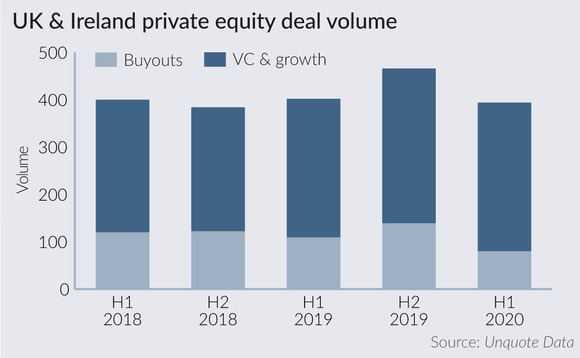

In the first half of 2020, total investment volume held up, with 398 deals in the UK and Ireland, according to Unquote Data. This figure is in line with H1 2019's investment volume of 404 deals, though it represents a 15% drop from the second half of 2019's record high of 470 deals.

But looking at the headline H1 figure hides the extent to which the coronovirus crisis took a toll on dealflow in the second quarter, especially when it comes to buyouts. Overall deal volume fell from 218 in Q1 2020 to 180 in Q2, reflecting the marked drop in both appetite and ability of GPs and VCs to make investments throughout the crisis. The decline was particularly pronounced among buyouts, which saw a drop from 59 transactions in the first quarter of 2020 to just 21 in Q2, the lowest level since the first quarter of 2009.

Rupert Templeman, a director at Eight Advisory, says: "When the coronavirus crisis hit, a lot of processes went on pause or ceased. Only a small portion carried on and completed. Private equity focused inwards for at least a month or so and, compared to continental Europe, the UK has been a bit slower to have volume return."

Aggregate buyout value dropped to a similar degree, from £12.9bn in Q1 to £4.7bn in Q2, as mega-deals were few and far between. The second quarter's largest PE-backed transaction was Warburg Pincus's deal to invest more than £250m in an acquisition of wealth manager Smith & Williamson (S&W) by Permira-backed Tilney. The proposed acquisition of S&W was confirmed in August 2019 by the company's largest shareholder, AGF Management, and is expected to be worth £1.8bn.

A quick exit

Exit volume also dropped, in Q2 especially. The second quarter of 2020 saw 39 exits, the lowest level since Q2 of 1997 and a 33% decrease on the 2019 Q2 volume. While this statistic reflects a reticence among GPs to put assets on the market in current conditions, the proportion of receiverships grew also. In Q2, receiverships represented 15% of exit volume, against 8% in Q2 of 2019 and 2019's annual rate of 7%.

Despite the severe decline, the UK & Ireland has fared better than other regions of Europe in terms of exit volume. Continental countries hit hardest and earliest by the pandemic saw an even sharper drop: exit activity fell by almost two thirds (65%) year-on-year in southern Europe in Q2, while France recorded a similar 60% decline.

Paul Mann, a partner at Squire Patton Boggs says: "We've seen more sale processes starting than there have been and there is already a material difference in activity in recent weeks. I think there are certainly challenges, but I'm encouraged by activity in the market."

Retail woes

From a sector perspective, the first half of 2020 indicated a further decline in interest in consumer companies among GPs. The percentage of consumer buyouts of total buyout volume dropped from 28% in the first half of 2019 to 22% in the same period in 2020. This follows a trend that has seen the percentage of total deals made up by consumer buyouts steadily drop from 35% of all buyouts in 2015 to 21% in 2019.

Market participants think this trend has been intensified by the coronavirus crisis. Mann says: "The retail sector is struggling through incredible difficulties right now. Thousands of jobs are at risk."

Across all types of investments, including growth capital and venture investments, as well as buyouts, the increasing importance of the technology sector to the UK PE industry was demonstrated in the half-yearly figures. The percentage of all investments made in companies in the technology sector grew from 44% in the first half of 2019 to 52% in the same period in 2020. This is another sector trend that has intensified following the Covid-19 outbreak, not least due to a shift towards remote working.

Managing partner David Barbour of FPE Capital says: "There's no question Covid-19 is accelerating digital uptake." He thinks this momentum in the sector is likely to carry on through 2020. "If we look at the public markets, we've seen a big recovery of multiples. There's a relatively large base of M&A boutiques with a technology focus and they feel they can transact. With the recovery in public markets and continuing technology dealflow, there's confidence in the intermediary channel."

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds