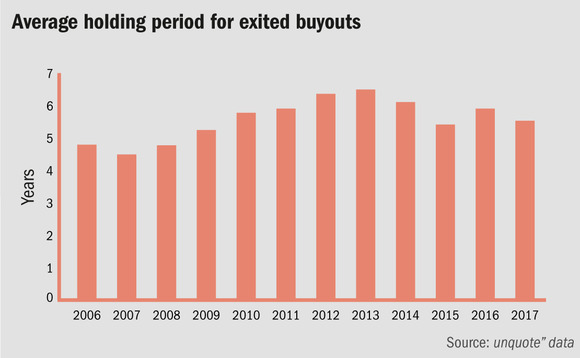

European holding periods continue return to five-year mark

Data from the unquote" database reveals how holding periods of buyout investments are slowly but surely returning to normal. Chris Papadopoullos reports

For buyouts exited in the first half of 2017, the average holding period of European targets was 5.5 years, down from 5.9 years for buyouts exited in 2016. The dip puts the market's return to normality back on track – it had looked on course to hit the five-year mark sooner, with investment periods dipping to 5.4 years in 2015 only to rebound the following year.

From 2006-2008, holding periods were below five years, with GPs turning over targets quickly amid rising asset prices. They began to steadily increase from 2008 onwards, hitting a peak of 6.5 years on average for assets exited in 2013 as GPs became reluctant to sell in weaker markets. But in the last two to three years, conditions for sellers have improved with increasing demand from both funds and corporates, boosted by successful years of fundraising and stronger corporate balance sheets.

The vast majority of pre-crisis baggage has now been offloaded and private equity houses are realising investments made well into the recovery, bringing investment periods down to more familiar territory. This is shown in the exit numbers, which have come down rapidly in the last three to four years after a large number of deals made before the financial crisis were finally sold off in 2013 and 2014.

The quicker churn of investments is becoming evident in the statistics when they are broken down into short (less than three years), medium (three to seven years) and long (at least seven years) holding periods.

There has been a substantial fall in the proportion of long holding periods, which has fallen to 28% from a peak of 40% in 2014. At the other end of the spectrum, the proportion of deals turned around in less than three years has climbed to 24% from a trough of 10% in 2012.

Some interesting regional differences are also apparent in the data. Holding periods in the UK peaked at a high average of 7.3 years in 2011 and have now returned to their 2006 level. However, across the rest of Europe, holding periods peaked much later but at a lower level. In the DACH region and France, for example, holding periods reached their high point in 2013 at 6.1 years for DACH and 6.7 years for France, and are yet to fully return to the levels they were at a decade ago.

Some of the most high-profile quick flips this year have been Verallia and Douglas Holding, which provided dividends through refinancing in less than two years, which unquote" records as a partial realisation. German industrial packaging firm Mauser, bought in 2014 for €1.2bn by Clayton Dubilier & Rice, was exited fully this year via a €2.1bn trade sale.

And while longer holding periods have been in decline, some substantial investment periods have ended this year, the most notable being the secondary buyout of IT consultants PQR from Gilde Equity Management, which first backed the company 20 years ago.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater