UK buyout activity cools off in second quarter

While buyout activity fell more sharply in the UK compared to other European markets in Q2, dealflow remained very strong by historical standards, Unquote Data shows.

In hindsight, matching the breakneck pace of UK investment seen in the first quarter of 2021 was always a tough ask. The rush to complete deals before a potential capital gains tax rate hike did drive dealflow, probably to a larger extent than was initially thought, and above and beyond the effect of a straightforward post-Covid recovery.

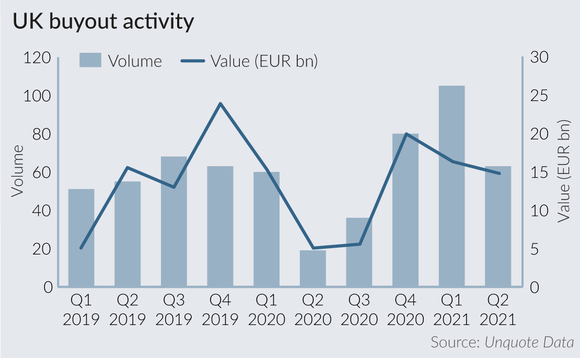

According to Unquote Data, UK buyout dealflow fell by 40% quarter on quarter in volume terms, with 63 transactions recorded versus 105 in the first three months of the year (and 80 in the preceding quarter).

This is a much sharper drop than that seen in other European markets, including France and Germany, where activity continued at roughly the same pace in the second quarter. As a result of this recalibrating, the UK was home to 19% of all European buyouts in Q2 – a figure much more in line with historical standards than the incredible 30% seen in Q1 – and France was once again the busiest European market by a very slim margin.

But there are a couple of important caveats to bear in mind with these headline figures.

The first is that while the quarter-on-quarter drop is steep, Q2 activity in the UK remained very strong indeed – comparing very favourably with Q2 2019 (55 deals) and overall the average of 59 deals per quarter in the year leading up to the Covid-19 outbreak. If anything, Q1 is the clear outlier with its sky-high tally of deals, which marked a 30% increase on the Q4 figure and was more than double the number of deals recorded in Q1 2019.

Furthermore, the aggregate value of these transactions did not fall nearly as sharply. Q1 deals were worth an estimated aggregate of EUR 16.3bn, while Q2 deals came close with EUR 14.7bn. As a result, the average value of UK buyouts in the second quarter stood at EUR 237m, up from EUR 155m in Q1.

This is down to the fact that most of the drop-off came from deals valued at less than EUR 150m (from 85 deals down to 44), while activity beyond this EV cut-off was virtually identical quarter on quarter. Clearly the UK's mid-market is alive and well – and in that context it is also not surprising to see that deals sourced through secondary buyouts (-15% quarter on quarter in volume terms) fared much better than deals coming from private vendors (which were more than halved in Q2).

Most active GPs in UK (H1 2021, buyouts only)

| GP | Number of deals | Estimated aggregate value of deals (EUR m) |

| Inflexion Private Equity | 5 |

720 |

| Carlyle Group | 4 |

1,622 |

| Endless | 4 |

70 |

| LDC | 4 |

189 |

| Palatine Private Equity | 3 |

166 |

| Astorg Partners | 3 |

936 |

| Intermediate Capital Group | 3 |

643 |

| Castik Capital Partners | 3 |

1,166 |

| CVC Capital Partners | 3 |

707 |

| Foresight | 3 |

43 |

| Bridges Fund Management | 3 |

120 |

| Bridgepoint | 3 |

204 |

Source: Unquote Data (all data correct as of 12 July 2021)

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds